Ecommerce Payment Processing 101: Everything You Need to Know

Payment processing for ecommerce is the backbone of online transactions, connecting customers to businesses and ensuring money moves securely and efficiently.

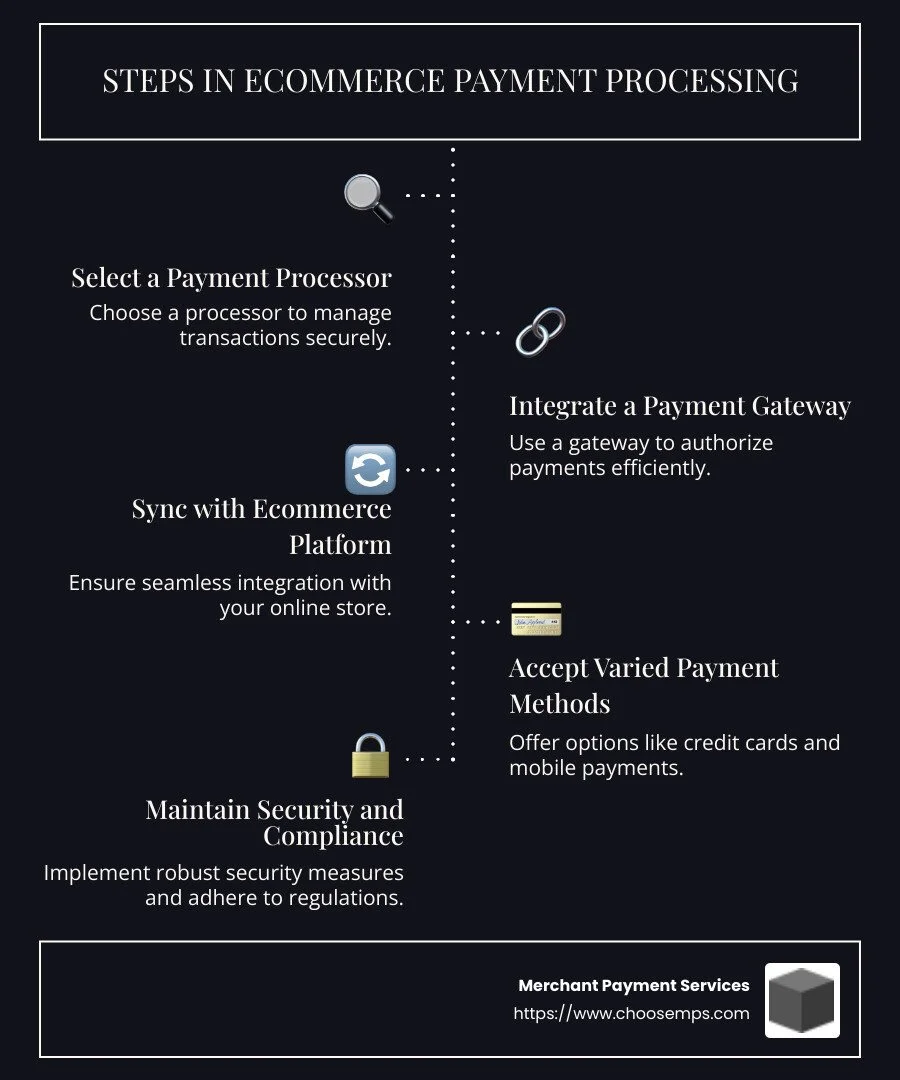

For quick answers on what this involves:

Choose a payment processor to handle transactions securely.

Use a payment gateway to authorize payments.

Sync these services with your ecommerce platform.

Accept varied payment methods like credit cards and mobile payments.

Ensure robust security and compliance with regulations.

The rise of ecommerce—a tidal wave that's expected to hit $5.9 trillion in global sales in 2023—has made understanding online payments essential for every business owner. With nearly 21% of all retail sales happening online this year, it's crucial to craft a payment strategy that aligns with customer needs and preferences.

I'm Lydia Valberg, and for over a decade, I've been guiding businesses through the complexities of payment processing for ecommerce. My experience in this field is deeply rooted in the family traditions of trust and transparency at Merchant Payment Services, where I've helped countless entrepreneurs steer secure, flexible payment solutions custom for growth.

Understanding Ecommerce Payment Processing

When diving into payment processing for ecommerce, grasp the key components: payment gateways, payment processors, and merchant accounts. Each plays a unique role in facilitating smooth online transactions.

Payment Gateways

Think of a payment gateway as the digital equivalent of a point-of-sale terminal in a physical store. It’s the technology that securely captures and transmits payment details from the customer to the payment processor. This process ensures sensitive data is encrypted and protected from prying eyes. For example, when a customer enters their credit card details on your site, the payment gateway securely sends this information to the processor for approval.

Payment Processors

Next up is the payment processor. This entity acts as the middleman between the customer’s bank and the merchant's bank. Once the gateway sends the payment information, the processor checks with the customer’s bank to ensure there are sufficient funds. If everything checks out, it authorizes the transaction and sends a confirmation back to the gateway. The payment processor is crucial as it handles the actual movement of funds, ensuring the merchant gets paid.

Merchant Accounts

Finally, a merchant account is where the money lands after a successful transaction. It's a special type of bank account that allows businesses to accept credit and debit card payments. Once the payment processor approves a transaction, the funds are deposited into the merchant account. From there, they can be transferred to the business's regular bank account, usually within a couple of days.

Understanding these components is vital for any business owner looking to succeed in the world of ecommerce. By leveraging the right combination of gateways, processors, and merchant accounts, businesses can ensure their payment systems are as seamless and secure as possible.

Key Components of Payment Processing for Ecommerce

When it comes to payment processing for ecommerce, ensuring security, preventing fraud, and maintaining compliance are paramount. Let's break down these critical components.

Security

Security is the backbone of ecommerce payment processing. With sensitive data like credit card numbers and personal information being transmitted, robust security measures are non-negotiable. Encryption and tokenization are commonly used to protect data. Encryption scrambles the data during transmission, while tokenization replaces sensitive information with a unique identifier or "token."

Why it matters: A secure payment system builds trust with your customers. They need to know their information is safe when they shop online.

Fraud Prevention

Fraud prevention is equally crucial. As online transactions increase, so do the risks of fraudulent activities. Implementing strong fraud detection tools, such as address verification and card security code checks, can help mitigate these risks. Monitoring transactions for unusual patterns can also alert businesses to potential fraud.

Case in point: Many ecommerce platforms experience spikes in fraud attempts during holiday seasons. By actively monitoring transactions, businesses can catch and prevent fraud before it happens.

Compliance

Compliance with industry standards and regulations, like the Payment Card Industry Data Security Standard (PCI DSS), is mandatory for any business processing payments. These standards ensure businesses manage cardholder data securely, reducing the risk of data breaches.

Here's the deal: Non-compliance can lead to hefty fines and damage to your reputation. Staying compliant not only protects your business but also assures your customers that you take their security seriously.

By prioritizing security, fraud prevention, and compliance, businesses create a secure and trustworthy environment for their customers. This not only protects the business but also improves the overall customer experience, paving the way for seamless transactions.

In the next section, we'll explore the popular ecommerce payment methods that cater to diverse customer preferences and needs.

Popular Ecommerce Payment Methods

In ecommerce, offering a variety of payment methods is crucial. It caters to different customer preferences and can significantly impact your sales. Let's explore some of the most popular ecommerce payment methods.

Credit Cards

Credit cards are the most widely used payment method in ecommerce. They offer convenience and speed for customers. When a customer uses a credit card, the payment processor contacts the card issuer (like Visa or Mastercard) to authorize the transaction. Once approved, the funds are transferred to the merchant's account.

Fun fact: Nearly 90% of online shoppers have used a credit card for their purchases. It's a must-have payment option for any ecommerce store.

Mobile Payments

With the rise of smartphones, mobile payments have become increasingly popular. Services like Apple Pay and Google Pay allow customers to make purchases with just a tap. About half of all ecommerce transactions are now made via mobile devices.

Why it matters: Mobile payments offer a fast and secure way for customers to shop, enhancing their experience and increasing the likelihood of completing a purchase.

Buy Now, Pay Later (BNPL)

BNPL services, like Shop Pay Installments, allow customers to split their payments into smaller, more manageable amounts. This method is particularly appealing for high-ticket items, as it reduces the upfront financial burden on customers.

Did you know? BNPL options can reduce cart abandonment rates by up to 20%. Offering this option can help capture sales from customers who might otherwise hesitate at the final checkout.

Bank Transfers

Bank transfers are another option, especially popular in business-to-business (B2B) ecommerce. Customers manually transfer funds from their bank accounts to the merchant's account. This method is often used for larger transactions and offers a secure way to handle payments.

Pro tip: While not as fast as other methods, bank transfers provide a reliable and trusted payment option for customers who prefer direct bank interactions.

By offering a range of payment options, you can cater to diverse customer preferences and increase your chances of closing a sale. Next, we'll dive into how the entire payment processing journey unfolds, from customer initiation to settlement.

How Payment Processing for Ecommerce Works

Understanding how payment processing for ecommerce works can help you streamline transactions and improve customer satisfaction. Let's break it down into three key stages: customer initiation, authorization, and settlement.

Customer Initiation

The journey begins when a customer decides to make a purchase. They browse your online store, add items to their cart, and proceed to checkout. Here, they enter their payment information, which could be a credit card number, mobile payment details, or another method. This step is crucial as it sets the stage for the rest of the transaction process.

Example: Imagine Sarah is buying a new pair of shoes online. She enters her credit card details on your website's checkout page. This is the initiation of the payment process.

Authorization

Once the payment information is submitted, the authorization process kicks in. The payment gateway securely transmits the customer's details to the payment processor. Then, the processor contacts the customer's bank or credit card issuer to verify the details and ensure sufficient funds are available.

This step is lightning-fast, often happening in seconds. If everything checks out, the transaction is approved. If not, it may be declined due to issues like insufficient funds or incorrect card details.

Quick Tip: A seamless authorization process reduces the chances of cart abandonment. Make sure your checkout page is optimized for speed and security.

Settlement

After authorization comes settlement. This is where the actual transfer of funds takes place. The payment processor sends a batch of approved transactions to the card networks, which then instruct the customer's bank to transfer the funds to the merchant's account. While authorization happens almost instantly, settlement can take a few days to complete.

Interesting Fact: The settlement process involves multiple parties, including card networks like Visa or Mastercard, ensuring that the funds move safely and securely from the customer to the merchant.

By understanding these stages, you can better manage your ecommerce transactions and ensure a smooth experience for your customers. Next, we'll guide you through choosing the right payment processor to meet your business needs.

Choosing the Right Payment Processor

Selecting the right payment processor is a crucial step in setting up your ecommerce business for success. It involves balancing security, international support, and costs. Let's explore these key factors.

Security Features

Security is non-negotiable in payment processing for ecommerce. Your customers trust you with their sensitive information, and it's your responsibility to protect it. Look for processors that offer robust security measures like SSL certificates and PCI compliance. These tools ensure that customer data is encrypted and transactions are secure.

Quick Tip: Always choose a payment processor that prioritizes security features to minimize the risk of fraud and data breaches.

International Support

If you're planning to sell beyond borders, international support is essential. A good payment processor should handle multiple currencies and be able to steer different tax systems. This ensures that you can cater to a global audience without a hitch.

Case Study: Gymshark uses a payment processor that supports international transactions, allowing them to bill customers in local currencies and manage regional taxes seamlessly.

Costs and Fees

Understanding the costs associated with payment processing is vital to maintaining healthy profit margins. Fees can include setup costs, monthly subscription fees, and transaction fees. Typically, transaction fees range from 1% to 5% of each sale plus a small flat fee.

Pro Tip: Compare different processors and their fee structures. Look for hidden costs that might add up over time. Opt for a solution that aligns with your business size and transaction volume.

By focusing on these factors, you can choose a payment processor that not only secures your transactions but also supports your business growth. Next, we'll address some frequently asked questions about ecommerce payment processing.

Frequently Asked Questions about Ecommerce Payment Processing

What is ecommerce payment processing?

Ecommerce payment processing is the backbone of online shopping. It involves the steps that occur between a customer deciding to make a purchase and the money landing in your business account. This process includes:

Authorization: Checking if the customer has enough funds.

Settlement: Transferring the funds from the customer's bank to yours.

These steps ensure that both parties—the buyer and the seller—complete the transaction securely and efficiently.

How does a payment gateway work?

A payment gateway is like a digital cashier. It handles the technical side of online transactions. When a customer clicks "buy," the payment gateway encrypts their payment information and sends it to the payment processor.

Here's a simplified breakdown:

Data Encryption: The gateway encrypts the customer's payment details.

Authorization Request: It sends the details to the payment processor to request authorization.

Response: The processor checks with the customer’s bank and sends back an approval or denial.

Completion: If approved, the transaction proceeds, and the customer gets a confirmation.

Fun Fact: This entire process happens in just a few seconds, ensuring a smooth shopping experience.

Which payment method is best for ecommerce?

Choosing the best payment method depends on your audience and business model. Here are some popular options:

Credit and Debit Cards: Widely used and accepted everywhere.

Digital Wallets: Options like PayPal or Apple Pay offer convenience and speed.

Buy Now, Pay Later (BNPL): Attracts customers who prefer flexible payment options.

Bank Transfers: Secure but can be slower compared to other methods.

Quick Tip: Offer multiple payment methods to cater to diverse customer preferences and increase conversion rates.

By understanding these key aspects of payment processing for ecommerce, you can create a seamless and secure shopping experience for your customers. This not only builds trust but also encourages repeat business. Next, we'll wrap up with some final thoughts on the role of Merchant Payment Services in enhancing customer experience and transaction efficiency.

Conclusion

In online shopping, seamless transactions are key to keeping customers happy and coming back for more. At Merchant Payment Services, we understand that a smooth payment process is crucial to achieving this. Our solutions are designed to make every transaction as easy and efficient as possible.

Exceptional Customer Experience: We prioritize customer satisfaction by offering payment processing solutions that are not only reliable but also flexible. With our risk-free, month-to-month agreements and no hidden fees, businesses can focus on what they do best—serving their customers—without worrying about unexpected costs.

Seamless Transactions: Our services ensure that every step of the payment processing for ecommerce—from authorization to settlement—happens quickly and securely. By integrating with leading POS systems and offering mobile payment options, we help businesses provide their customers with a frictionless checkout experience.

Why Choose Us? With locations across the Midwest, we are committed to providing exceptional service and integrity. Our free terminals and easy-to-use systems are custom to meet the needs of businesses of all sizes. Plus, our commitment to security and compliance means you can trust us to handle your transactions safely.

Ready to improve your ecommerce payment experience? Explore our online processing solutions and find how Merchant Payment Services can help you create a seamless and secure shopping journey for your customers.