Mobile Payments 101: Understanding the Basics

Mobile payments are changing how businesses and customers interact. These digital transactions allow customers to pay using mobile devices, making purchases quicker and more convenient than ever. Whether tapping your phone at a payment terminal or sending money through an app, mobile payments streamline the buying process. They are secure, fast, and increasingly essential in today’s digital age.

To put it simply:

What are mobile payments? Digital transactions made using a mobile device.

Why use them? They are fast, secure, and very convenient.

How does it work? Typically through mobile wallets and NFC technology or QR codes.

Who benefits? Both businesses looking to simplify payments and customers seeking quick purchase options.

As a retail business owner, embracing mobile payments can help reduce costs and improve customer satisfaction. If you're aware of high transaction fees or seek simple payment systems, mobile solutions might be just what you need.

I’m Lydia Valberg, co-owner at Merchant Payment Services. With a rich family legacy of providing reliable payment solutions, my experience in mobile payments ensures we support your business with integrity and ease. Now, let's dive into mobile payments and find how it can benefit your business.

Types of Mobile Payments

Mobile payments come in various forms, each offering unique ways to make transactions smoother and more efficient. Let's explore the main types:

Mobile Wallets

Mobile wallets are digital versions of your physical wallet. They store your payment information securely on your smartphone or smartwatch. Popular examples include Apple Wallet, Google Wallet, and Samsung Wallet. These apps can hold not just credit and debit cards but also loyalty cards, tickets, and more.

How they work: Simply add your card details to the app. When you're ready to pay, hold your device near the NFC-enabled terminal and authorize the payment using a passcode, fingerprint, or facial recognition.

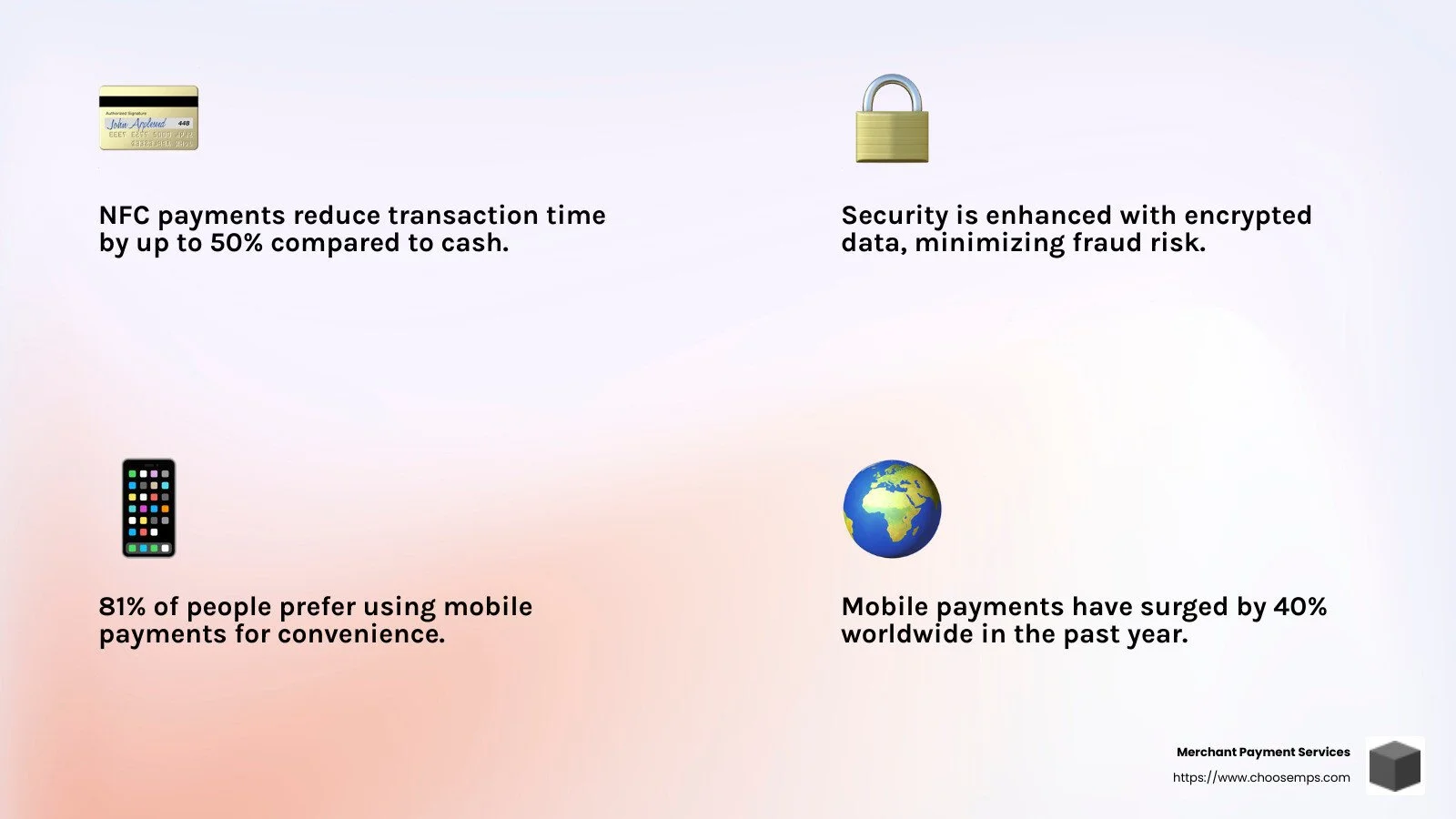

NFC Payments

NFC (Near-Field Communication) payments allow you to make contactless transactions by simply tapping your mobile device or card on a payment terminal. Apple Pay and Google Pay are examples of this technology in action.

Benefits: NFC payments are fast and secure. They use encryption to protect your data, ensuring that your payment information is safe from interception.

P2P Apps

Peer-to-Peer (P2P) apps like Venmo and Cash App let you send money to friends and family with ease. These apps are perfect for splitting bills or sending quick payments.

How they work: Link your bank account or card to the app, enter the amount, and send it to a contact in your phone. It's that simple!

SMS Payments

SMS payments are less common but still useful in certain situations. They allow you to make payments or donate to charities by sending a text message.

Use case: Often used for small transactions like buying event tickets or participating in charity drives. Just send a text with the payment amount, and it gets added to your phone bill.

mPOS (Mobile Point of Sale)

Mobile Point of Sale systems (mPOS) turn your smartphone or tablet into a payment terminal. This is ideal for businesses on the go, like food trucks or market stalls.

How they work: Attach a small card reader to your device, and use an app to process payments. The Payanywhere 3-in-1 Bluetooth Credit Card Reader is a great example, accepting EMV chip, magstripe, and NFC payments.

Each type of mobile payment offers unique benefits, making transactions more convenient and secure for both businesses and customers. Embracing these technologies can improve the shopping experience and streamline operations.

How Mobile Payments Work

Understanding how mobile payments function can help you make informed decisions about using them. Let's explore the core technologies and security measures that make mobile payments possible.

NFC Technology

Near-Field Communication (NFC) is the backbone of many mobile payment systems. It allows two devices to communicate wirelessly when they're close together, typically within two inches. Think of NFC as a digital handshake between your phone and a payment terminal. This technology is what powers many popular mobile payment services.

How it works: When you tap your phone on an NFC-enabled terminal, your device sends encrypted payment information to the terminal. This process is quick, taking just a few seconds to complete.

QR Codes

QR codes offer another way to make mobile payments, especially in regions where NFC isn't widely adopted. These codes are scanned by your smartphone to initiate a payment.

How it works: Open your mobile wallet app and scan the QR code displayed by the merchant. The app will then prompt you to confirm the payment. This method is popular in various regions around the world.

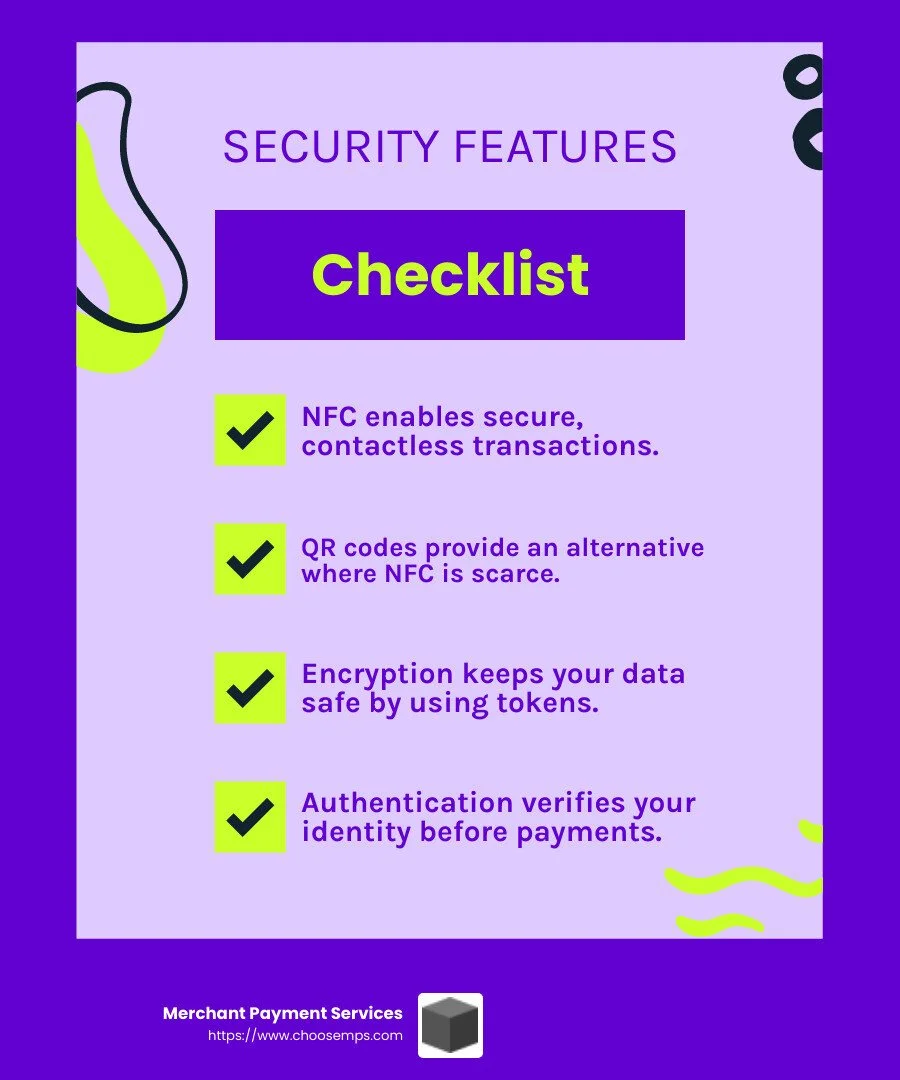

Encryption

Encryption is crucial for keeping mobile payments secure. It transforms your payment data into a secure code that can only be decrypted by authorized parties.

Why it matters: Instead of transmitting your actual card number, mobile payment systems use encrypted tokens. This means even if someone intercepts the data, they can't access your sensitive information.

Authentication

Authentication adds an extra layer of security to mobile payments. Before you can complete a transaction, you must verify your identity.

Methods of authentication:

Passcodes: Enter a unique code to authorize the payment.

Biometrics: Use fingerprint or facial recognition for quick and secure approval.

These measures ensure that only you can authorize payments from your device, reducing the risk of fraud.

By leveraging technologies like NFC, QR codes, encryption, and authentication, mobile payments provide a fast, secure, and convenient way to transact. Understanding these elements can help you feel more confident in using mobile payments in your daily life.

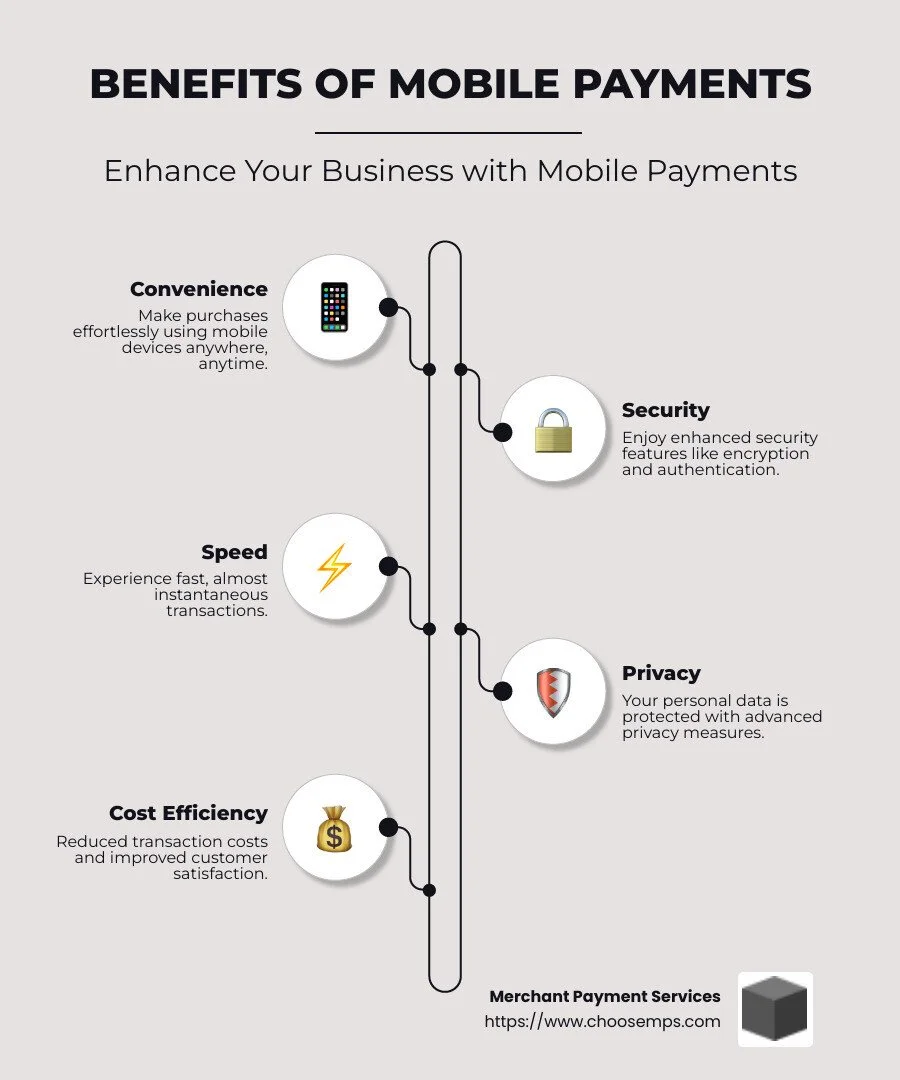

Benefits of Mobile Payments

Mobile payments are reshaping how we pay for goods and services, offering a host of benefits that make them a preferred choice for many.

Convenience

One of the standout advantages of mobile payments is convenience. You can leave your bulky wallet at home and pay with just a tap or scan on your smartphone. This eliminates the need to carry cash or physical cards. Whether you're grabbing a coffee or shopping online, mobile payments make the process seamless and straightforward.

Security

Security is a top priority when it comes to mobile payments. These transactions use advanced encryption to protect your data. Unlike traditional cards, mobile payments often require authentication through a passcode or biometric methods like fingerprint or facial recognition. This ensures that even if your phone is lost or stolen, unauthorized users can't make payments.

Speed

Speed is another major benefit. Mobile payments are processed in the blink of an eye, often faster than swiping a card or handling cash. This quick transaction time is crucial for busy shoppers and merchants, reducing wait times at checkout.

Privacy

Privacy is improved with mobile payments. Since individual security codes are generated for each transaction, your actual card number is never shared with the merchant. This adds an extra layer of privacy, keeping your financial details safe from prying eyes. Plus, with mobile payments, no one sees the kind of card you're using, which can be a relief in certain social situations.

By offering convenience, security, speed, and privacy, mobile payments are not just a trend—they're becoming a cornerstone of modern commerce. As more people accept this technology, the benefits will continue to grow, making transactions easier and safer for everyone.

Frequently Asked Questions about Mobile Payments

What is a mobile payment?

A mobile payment is a digital transaction made using a mobile device like a smartphone, tablet, or smartwatch. Instead of using cash or a physical card, you pay through an app on your device. This can involve tapping your phone on a payment terminal or scanning a QR code. It's a fast, secure way to pay, without needing to carry a wallet.

What are the advantages and disadvantages of mobile payments?

Advantages:

Convenience: Mobile payments let you pay quickly and easily. No need to dig through your bag for a wallet—just tap or scan with your phone. This is especially handy when you're in a rush or have your hands full.

Security: Mobile payments are very secure. They use encryption to keep your data safe. Plus, most require authentication like a fingerprint or face scan, making it harder for someone else to use your phone for payments.

Speed: Transactions are fast, often quicker than using a cash or card. This means less time waiting in line at stores.

Disadvantages:

Technology Issues: Sometimes, technology can fail. Your phone might run out of battery, or the app might not work properly. It's always good to have a backup payment method.

Limited Acceptance: Not all stores accept mobile payments yet, so you might still need a card or cash in some places.

How do you use mobile payments?

There are a few ways to use mobile payments:

NFC (Near Field Communication): This technology allows you to pay by tapping your phone on a payment terminal. Apps like Apple Pay and Google Pay use NFC to make transactions fast and contactless.

QR Codes: Some apps let you scan a QR code to pay. You simply point your phone's camera at the code, and the payment app takes care of the rest.

Mobile Apps: Many apps, like PayPal or Venmo, let you send money to friends or pay for things online. You enter the payment details in the app, and it processes the transaction for you.

These methods make mobile payments versatile and easy to use, whether you're shopping in person or online.

Conclusion

As we wrap up our exploration of mobile payments, it's clear that this technology is changing the way we handle transactions. With the rise of mobile wallets, NFC payments, and mobile apps, paying for goods and services has never been easier or more secure.

At Merchant Payment Services, we are committed to providing top-notch payment solutions custom to your business needs. Our offerings include free terminals, POS systems, and mobile payment options that ensure you stay ahead in this fast-evolving landscape. We pride ourselves on our exceptional service, emphasizing a risk-free, month-to-month agreement with no hidden fees. This allows your business to accept the benefits of mobile payments without worry.

Whether you're a small business owner or part of a larger enterprise, integrating mobile payments into your operations can improve customer experience and streamline your processes. Our team is here to support you every step of the way, ensuring a smooth transition to a more efficient payment system.

For more information on how we can help you harness the power of mobile payments, visit our mobile payment solutions page. Let's work together to make your payment process seamless and secure.