Education's Best Bet: Payment Solutions for Schools

Payment solutions for education are changing the financial landscape in schools by streamlining transactions, reducing costs, and enhancing the overall experience for students, parents, and staff. Whether you're managing payments at a public school or a private university, integrating modern payment systems can drastically simplify your financial processes. Here’s a quick overview:

Achieve faster and more secure transactions with the latest technology.

Boost efficiency by cutting down manual handling and associated errors.

Improve user experience for students, parents, and administrators alike.

In the coming paragraphs, we'll dive into education payment solutions. We'll look at why these systems are critical in today's digital-first environment, how they can benefit educational institutions, and the leading providers in the field. Plus, you’ll find why more schools are pivoting to payment solutions custom for educational needs.

As you dive into this guide, remember I'm Lydia Valberg, here to untangle the complexities of payment solutions for education. From my years of experience in the payment industry, I offer insights that align with your school's vision for modern financial management.

Understanding Payment Solutions for Education

Payment processing for educational institutions is evolving rapidly. Schools are moving away from traditional methods like cash and checks towards more efficient, secure, and convenient online payment systems.

Why the Shift?

The shift to digital payments isn't just a trend—it's a necessity. Schools need to manage payments for tuition, fees, extracurricular activities, and more. Doing this through outdated systems can be cumbersome and error-prone. Here's why modern payment solutions are a game-changer:

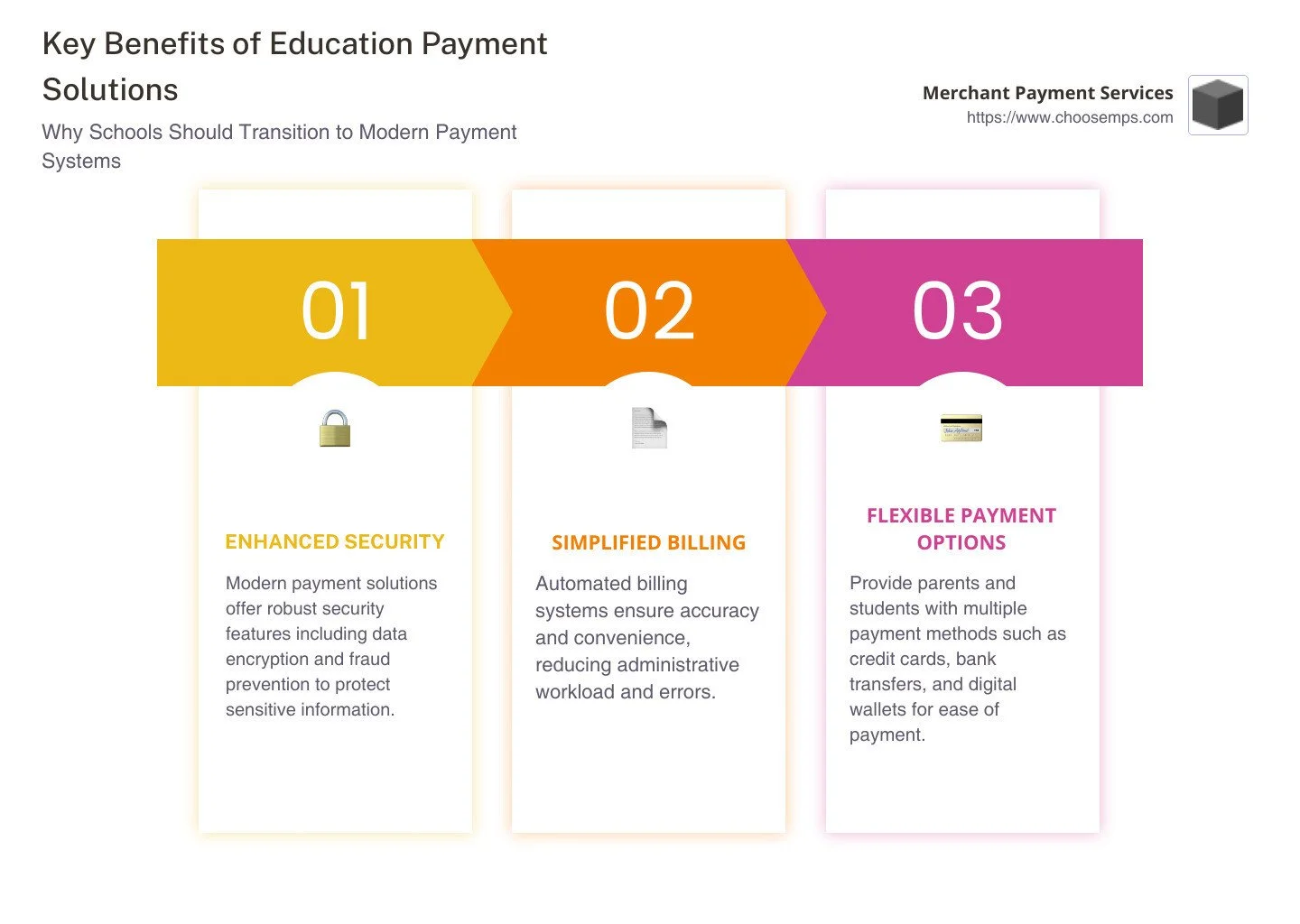

Improved Security: With increasing concerns about data breaches, schools must prioritize secure payments. Modern payment solutions use encryption and other security protocols to protect sensitive information, ensuring peace of mind for both institutions and families.

Convenience and Accessibility: Online payment systems allow parents and students to make payments anytime and anywhere. This flexibility is crucial for busy families and helps reduce late payments.

Streamlined Operations: By automating payment processing, schools can reduce administrative workloads. This means less time spent on manual data entry and more time focusing on what really matters—education.

Key Components of Payment Solutions

Payment Gateways: These are the digital bridges that connect the school's payment system with financial institutions. They ensure that transactions are processed smoothly and securely.

Transaction Validation: Before a payment is processed, it needs to be validated. This involves checking the payment details for accuracy and ensuring there are sufficient funds. It’s a crucial step to prevent fraud and errors.

Integration with Student Information Systems (SIS): Seamless integration with SIS allows for better tracking of student payments and financial records. This integration simplifies reporting and ensures all financial data is up-to-date.

Benefits of Implementing Payment Solutions in Schools

Implementing payment solutions for education offers numerous benefits that can transform how schools handle their financial transactions. Let's explore how these systems can improve administrative efficiency, create a cashless campus, and simplify tracking.

1. Administrative Efficiency

One of the biggest advantages of modern payment systems is the boost in administrative efficiency. Schools can automate repetitive tasks that previously required manual effort, such as processing checks or cash payments. This automation reduces the workload on administrative staff, freeing them up to focus on more critical tasks.

Less Paperwork: By going digital, schools can significantly cut down on paperwork. This not only saves time but also reduces the risk of errors associated with manual data entry.

Quick Training: As noted by EFS, these systems are easy to implement and quick to train staff on, ensuring a smooth transition with minimal disruption.

2. Cashless Campus

Moving towards a cashless campus is another significant benefit. By eliminating cash transactions, schools can streamline operations and create a safer environment for students and staff.

Reduced Risk of Theft: Without cash on hand, the risk of theft decreases, leading to a safer school environment.

Convenience for Families: Parents and students can make payments online, leading to fewer late fees and more timely payments. This convenience is especially important for busy families.

3. Simplified Tracking

Payment solutions also offer simplified tracking of financial transactions, making it easier for schools to manage their finances.

Real-Time Reporting: With integrated systems, schools can access real-time reports on payments, helping them keep track of finances effortlessly.

Better Financial Management: Schools can easily generate financial reports and track outstanding payments, ensuring they have a clear picture of their financial health.

In summary, adopting payment solutions for education can lead to more efficient administration, a safer cashless campus, and simplified financial tracking. These benefits not only improve the school's operations but also improve the overall experience for students and families.

Next, we'll dive into the leading payment solutions available for educational institutions and how they can be integrated seamlessly into school systems.

Leading Payment Solutions for Education

When it comes to payment solutions for education, Merchant Payment Services (MPS) stands out as a top choice for schools looking to modernize their financial transactions. Let's explore how MPS can revolutionize financial management in educational settings.

Merchant Payment Services

Merchant Payment Services offers a comprehensive suite of tools designed specifically for the education sector. This includes secure and efficient online payment systems that integrate seamlessly with existing school operations.

Key Features:

Customizable E-commerce Processing: MPS allows schools to tailor their checkout experience, ensuring that it aligns with their branding and operational needs.

Multiple Payment Gateways: Schools can choose from a variety of secure and affordable gateways, making it easy to switch to MPS without disrupting existing processes.

Integration with POS Systems: MPS partners with popular point-of-sale systems, allowing schools to manage both online and in-person transactions smoothly.

Virtual Terminal Access: Schools can easily accept payments through various channels, such as email invoicing and phone payments, using MPS's secure online merchant portal.

With these features, Merchant Payment Services simplifies the payment process for schools, reducing administrative burdens and enhancing the overall user experience for students, parents, and staff.

Benefits of Online School Payment Systems

Online school payment systems, like those offered by MPS, provide robust solutions for educational institutions. These systems focus on streamlining payment processes and improving financial transparency.

Advantages:

Faster Transactions: Online payment systems speed up the payment process, allowing schools to receive funds quicker and manage cash flow more effectively.

Improved Security: By leveraging advanced security measures, these systems protect sensitive financial data, ensuring compliance with industry standards.

Improved User Satisfaction: Schools can significantly improve student and parent satisfaction by offering a hassle-free payment experience that reduces call center loads and document delivery costs.

Incorporating these leading payment solutions into school systems not only improves operational efficiency but also fosters a more positive experience for all stakeholders involved. As schools continue to accept digital change, these solutions will play a pivotal role in shaping the future of education finance.

Next, we'll explore how these payment solutions work in educational settings, including the role of payment gateways and system integration.

How Payment Solutions Work in Educational Settings

Implementing payment solutions for education involves several key components that ensure smooth, secure, and efficient financial transactions. Let's break down these components and see how they fit into the educational landscape.

Payment Gateway

A payment gateway acts as a bridge between a school's financial system and the payment processor. It securely transfers payment information from students or parents to the payment processor, ensuring that transactions are safe and efficient.

Key Functions of a Payment Gateway:

Data Encryption: Protects sensitive information during transmission.

Transaction Authorization: Validates payment details before processing.

Fraud Detection: Uses advanced algorithms to identify and prevent fraudulent activities.

For schools, a robust payment gateway is essential for maintaining trust and security in online transactions.

Transaction Validation

Transaction validation is the process of verifying the legitimacy of a payment before it is completed. This step is crucial in preventing errors and ensuring that the funds are available.

Steps in Transaction Validation:

Verification of Payment Details: Checks the accuracy of card numbers, expiration dates, and other critical information.

Authentication: Confirms the identity of the payer, often through security measures like OTPs (One-Time Passwords).

Confirmation: Once validated, the transaction is approved, and a confirmation is sent to both the payer and the school.

By ensuring that each transaction is validated, schools can minimize the risk of chargebacks and disputes.

Integration with Student Information Systems (SIS)

For a seamless experience, payment solutions should integrate with a school's Student Information System (SIS). This integration allows for automatic updates of student records and financial accounts.

Benefits of SIS Integration:

Real-Time Updates: Automatically updates student accounts with payment records, reducing manual data entry.

Simplified Reporting: Provides comprehensive financial reports that are easily accessible to school administrators.

Improved Communication: Sends automated reminders and notifications to parents and students about upcoming payments or outstanding balances.

With SIS integration, schools can streamline administrative tasks and improve communication with students and parents.

In summary, the combination of a secure payment gateway, thorough transaction validation, and seamless SIS integration creates a robust framework for handling educational payments. These elements work together to ensure that schools can manage their finances effectively while providing a positive experience for all users involved.

Next, we'll dive into some frequently asked questions about payment solutions for education, addressing common concerns and providing clarity on how these systems benefit schools.

Frequently Asked Questions about Payment Solutions for Education

What are the key features of education payment solutions?

Education payment solutions come with a variety of features designed to make transactions easier and more secure for schools. Here are some of the key features:

Multiple Payment Options: Accepts credit cards, debit cards, checks, and digital wallets, offering flexibility to parents and students.

Recurring Billing: Allows for automatic, scheduled payments, reducing the likelihood of missed payments.

Integration with School Systems: Seamlessly connects with Student Information Systems (SIS) and accounting software like QuickBooks.

User-Friendly Interface: Simple to navigate for both administrators and users, minimizing the learning curve.

Comprehensive Reporting: Provides detailed financial reports to help schools track payments and manage funds efficiently.

These features ensure that schools can manage payments efficiently, providing convenience for both the institution and its community.

How do payment solutions improve school administration?

Implementing payment solutions in schools can significantly improve administrative efficiency. Here's how:

Automated Processes: Reduces manual data entry by automating payment tracking and record updates.

Simplified Payment Collection: Centralizes all payment activities, making it easier to manage and reconcile accounts.

Improved Communication: Sends automatic reminders for upcoming payments and alerts for overdue balances, keeping parents informed.

Improved Cash Flow Management: Provides real-time insights into financial transactions, helping schools manage their budget more effectively.

By streamlining these processes, payment solutions allow school administrators to focus more on educational priorities rather than financial logistics.

What are the security measures in place for education payment systems?

Security is a top priority for education payment systems. Here are some of the measures in place to protect sensitive information:

Data Encryption: Encrypts payment data during transmission to prevent unauthorized access.

Fraud Detection: Uses advanced algorithms to identify and block suspicious activities before they occur.

Secure Authentication: Implements multi-factor authentication, such as OTPs, to verify the identity of users.

Compliance with Standards: Adheres to industry standards like PCI DSS to ensure that all transactions are conducted safely.

These security measures work together to safeguard both the school and its users, ensuring that sensitive financial data remains protected at all times.

These FAQs highlight the essential aspects of payment solutions for education, addressing common concerns and demonstrating their value in educational settings.

Conclusion

Incorporating payment solutions for education can transform the way schools handle financial transactions, making the process seamless and user-friendly. At Merchant Payment Services, we prioritize delivering a smooth payment experience that benefits everyone involved—students, parents, and administrators alike.

Our solutions offer seamless payment integration, connecting effortlessly with existing school systems like Student Information Systems (SIS) and accounting software. This integration minimizes manual work and reduces errors, allowing school staff to focus on what truly matters—education.

Implementing these advanced payment solutions not only streamlines administrative tasks but also significantly improves the overall user experience. With features like multiple payment options and user-friendly interfaces, parents and students can enjoy a hassle-free transaction process. Automated reminders and alerts keep everyone informed, reducing the chances of missed payments and easing financial management for schools.

At Merchant Payment Services, we are committed to providing exceptional service and integrity. Our risk-free, month-to-month agreements with no startup or hidden fees underscore our dedication to helping educational institutions optimize their payment processes.

For schools looking to improve their payment systems, Merchant Payment Services is your trusted partner. Explore our offerings and see how we can help you create a cashless, efficient campus. Learn more about our online processing solutions.

By choosing the right payment solutions, schools can ensure a secure, efficient, and enjoyable experience for all users, paving the way for improved educational outcomes.