Swipe to Success: Mobile Payment Solutions for Your Business

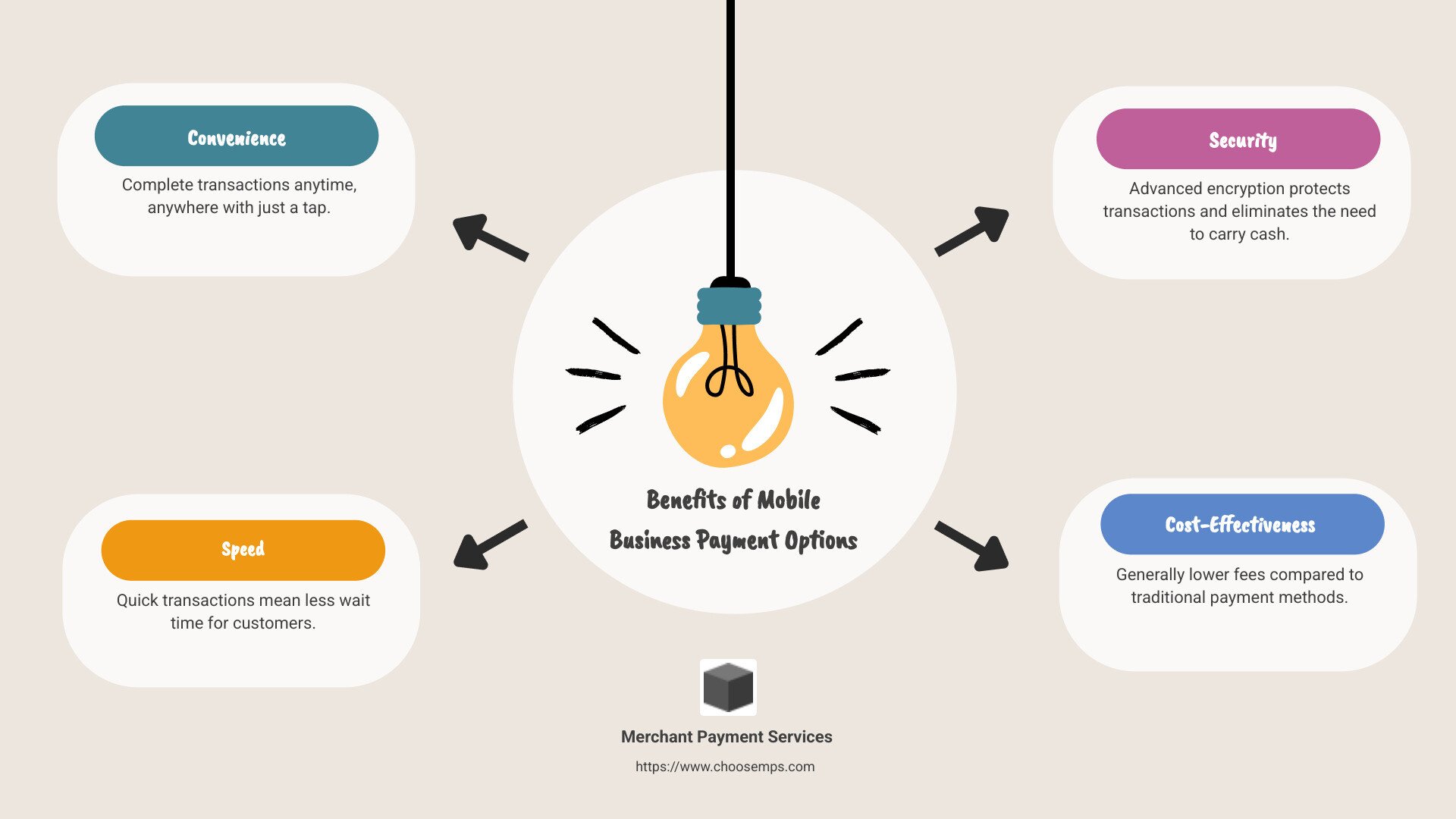

Mobile business payment options have revolutionized how transactions are conducted, bringing speed, security, and convenience to merchants and consumers alike. If you're looking for a straightforward answer, here are the key benefits of using mobile business payment options:

Convenience: Transactions can be completed anytime, anywhere, with just a tap.

Speed: Quick transactions mean less wait time for your customers.

Security: Advanced encryption and no need to carry cash or physical cards.

Cost-Effective: Generally lower fees compared to traditional payment methods.

Mobile payments and digital wallets offer a seamless way to manage transactions through devices like smartphones and tablets. They eliminate the hassle of physical cash and cards, providing a superior customer experience, whether you're in a busy retail store or managing sales from home. With options ranging from NFC payments to digital invoicing, businesses can choose the best fit for their operational needs.

I’m Lydia Valberg, co-owner at Merchant Payment Services, deeply committed to preserving our legacy of trust and community over 35 years. My experience is rooted in helping businesses steer mobile business payment options with clarity and ease. This article will guide you through choosing the perfect solution to not only meet your business needs but to also improve your operations as you continue to grow.

Understanding Mobile Business Payment Options

Navigating mobile business payment options can seem daunting, but it's easier than you think. Let's break down the main types of mobile payments that can help your business thrive.

NFC Payments

Near-field communication (NFC) payments are a popular choice for businesses. They allow customers to pay by simply tapping their smartphone or smartwatch near a payment terminal. This method is quick and secure, thanks to encrypted data transfer. NFC payments are perfect for busy retail environments where speed and convenience are key.

QR Code Payments

QR code payments are another simple and efficient option. Customers scan a QR code with their mobile device to complete a transaction. This method is particularly useful for businesses that don't have traditional point-of-sale systems. It's also great for outdoor events or pop-up shops where flexibility is needed.

SMS Payments

SMS payments allow customers to pay via text message. This is a handy option for businesses that want to offer a straightforward payment experience without the need for apps or internet access. SMS payments are often used for donations or quick transactions where simplicity is paramount.

Billing Apps

Billing apps streamline the invoicing process by allowing businesses to send bills directly to customers' mobile devices. Customers can then pay instantly through their preferred mobile payment method. This option is ideal for service-based businesses that need to manage recurring payments or detailed invoices.

MST Payments

Magnetic Secure Transmission (MST) payments use magnetic signals to communicate with traditional card readers. This means customers can use their mobile devices to pay even if the business doesn't have a contactless terminal. While less common than NFC, MST payments offer flexibility for businesses transitioning to mobile payment solutions.

Each of these mobile business payment options offers unique benefits, allowing you to tailor your payment methods to suit your business model and customer preferences. By understanding these options, you can improve your operations and provide a seamless payment experience for your customers.

Top Mobile Payment Methods for Businesses

Mobile payment methods are changing how businesses handle transactions. Let's explore the top mobile business payment options that can lift your business operations.

Contactless Payments

Contactless payments are quickly becoming the norm in retail and service industries. With a simple tap of a smartphone or smartwatch, customers can pay without needing to swipe a card or handle cash. This method is not only fast but also reduces physical contact, making it a sanitary choice for both businesses and customers. Plus, it's backed by encrypted data, adding an extra layer of security.

Digital Wallets

Digital wallets like Apple Pay, Google Pay, and Samsung Pay are gaining popularity for their convenience and security. These apps store users' payment information securely, allowing them to make payments with just a few taps. For businesses, accepting digital wallets can speed up the checkout process and appeal to tech-savvy customers who prefer using their phones over traditional wallets.

Mobile Invoicing

Mobile invoicing is a game-changer for service-based businesses. With apps like Invoice Simple, businesses can send invoices directly to customers' phones, who can then pay instantly using their preferred payment method. This not only streamlines the billing process but also improves cash flow by reducing the time it takes to get paid. Mobile invoicing is especially beneficial for freelancers, consultants, and small businesses that rely on prompt payments.

Peer-to-Peer Payments

Peer-to-peer (P2P) payments are an excellent option for businesses that deal with small transactions or need to split payments among multiple parties. Apps like Venmo and Cash App make it easy for customers to send and receive money using their mobile devices. For businesses, offering P2P payment options can improve customer satisfaction by providing a flexible and modern payment experience.

By adopting these mobile payment methods, businesses can offer a seamless, efficient, and secure payment experience. Whether you're running a retail store, a restaurant, or a service-based business, these options can help you stay competitive and meet the evolving needs of your customers.

Benefits of Mobile Payment Solutions

Mobile payment solutions are revolutionizing the way businesses accept payments. Here’s why adopting these modern methods can be a game-changer for your business.

Convenience

Mobile payments make transactions effortless for both businesses and customers. With a few taps on a smartphone, payments can be completed anytime, anywhere. This ease of use can lead to higher customer satisfaction and loyalty, as people appreciate the ability to pay quickly without the need for cash or cards.

Speed

Speed is a significant advantage of mobile payments. Transactions are processed faster than traditional methods, reducing checkout times. Customers no longer have to wait for cashiers to count change or swipe cards. This efficiency not only improves the shopping experience but also allows businesses to serve more customers in less time.

Security

Security is a top priority for mobile payment solutions. They use advanced encryption and tokenization to protect sensitive information. Unlike physical cards, mobile payment apps do not store actual card numbers on devices, reducing the risk of fraud and data breaches. This added security can give both businesses and customers peace of mind.

Reduced Costs

Mobile payments can also help businesses cut costs. They often come with lower transaction fees compared to credit card companies. Additionally, the streamlined checkout process can decrease labor costs, as employees spend less time handling payments. Over time, these savings can significantly impact a business's bottom line.

Contactless Payments

The demand for contactless payments has surged, especially in light of health and safety concerns. With mobile payments, customers can pay without touching point-of-sale machines or exchanging cash. This sanitary option not only meets customer expectations but also complies with health guidelines, making it a smart choice for businesses aiming to provide a safe shopping environment.

Embracing mobile payment solutions can lead to a more efficient, secure, and customer-friendly payment process. As businesses continue to adapt to changing consumer preferences, these benefits make mobile payments an essential tool for success.

How to Choose the Right Mobile Payment Solution

Finding the right mobile business payment options can feel like a daunting task, but it doesn't have to be. Here's a simple guide to help you make the best choice for your business:

1. Understand Your Business Needs

Every business is unique. Start by identifying what your business specifically requires. Do you need to process payments online, in-store, or both? Are your customers tech-savvy, or do they prefer traditional payment methods? Understanding these needs will guide you towards the most suitable payment solution.

For example, if you run a café in a tech-heavy area like Chicago, offering digital wallets might appeal to your customers. On the other hand, if you manage a local store in a smaller town, you might prioritize a solution that offers both mobile and traditional payment options.

2. Compare Fee Structures

Fees can eat into your profits if you're not careful. While many mobile payment solutions boast "no fees," dig deeper. Some banks or services might charge transaction fees, monthly fees, or even fees for certain types of payments.

Consider the overall cost of each option. It's crucial to weigh these costs against the benefits each solution offers.

3. Check for Integrations

Your payment solution should seamlessly integrate with your existing systems. Whether it's your accounting software, inventory management, or e-commerce platform, smooth integration can save time and reduce errors.

For instance, if you're using an e-commerce platform, you might want a payment solution that integrates directly with it. This can streamline your operations and make it easier to track sales and inventory.

4. Consider Scalability

As your business grows, your payment solution should grow with you. Look for options that offer scalability, allowing you to add features or handle more transactions as needed.

A scalable solution can manage complex billing scenarios and scale with your business needs.

5. Look for Flexibility

Flexibility is key in today's business environment. Choose a payment solution that offers multiple payment methods, such as NFC, QR codes, or even SMS payments. This flexibility can help you cater to a broader range of customers and their preferences.

By considering these factors, you can choose a mobile payment solution that not only meets your current needs but also supports your future growth. The right choice can lead to increased customer satisfaction and business success.

Frequently Asked Questions about Mobile Business Payment Options

What is mobile payment processing?

Mobile payment processing is a way for businesses to accept payments using mobile devices like smartphones or tablets. This method allows customers to pay quickly and securely, without needing cash or physical cards. Mobile payments can be made through apps, digital wallets, or even by scanning QR codes.

How secure are mobile payments?

Security is a top priority in mobile payments. Transactions are protected by encryption, which scrambles the customer's information so it can't be easily accessed by hackers. Many mobile payment providers also follow PCI standards (Payment Card Industry Data Security Standard), which are strict rules designed to keep payment data safe. These measures make mobile payments more secure than traditional card payments.

What are the costs associated with mobile payments?

Mobile payment solutions often come with costs, but they can vary. Some providers charge a subscription fee, which is a regular payment for using their service. Others might have transaction fees, which are small charges for each payment processed. It's important to read the fine print and understand all potential costs before choosing a provider. This way, you can avoid surprises and choose a solution that fits your budget and business needs.

Conclusion

In today's world, flexibility in payment options is crucial for businesses to keep up with customer demands. At Merchant Payment Services, we understand this need and are committed to providing you with mobile business payment options that are not only adaptable but also straightforward. Our services are designed to improve customer satisfaction by offering a seamless payment experience, whether you're operating a busy retail store or a cozy coffee shop.

One of the standout features of our service is the absence of hidden fees. We believe in transparency and integrity. Our month-to-month agreements are risk-free, allowing you to focus on growing your business without worrying about unexpected charges. This approach ensures that you can manage your finances effectively while enjoying the benefits of a robust payment processing solution.

With our range of mobile payment solutions, you can cater to a diverse customer base and tap into the convenience and efficiency that digital transactions offer. Whether it's contactless payments, digital wallets, or mobile invoicing, our solutions are designed to integrate smoothly with your existing operations.

Ready to explore how our mobile payment solutions can benefit your business? Learn more about our offerings here and take the first step towards a more flexible and customer-friendly payment process.