ATM Investments: Cashing in on Opportunities

Investing in ATM Machine businesses is a unique way to generate passive income and explore exciting investment opportunities. As cash transactions continue in high-demand areas, ATMs offer a steady revenue stream mostly through surcharge fees. For small retail business owners, they present a low-effort method to increase profit margins. While some barriers such as upfront costs, technology upgrades, and regulatory requirements exist, the potential benefits can significantly outweigh them.

Quick Takeaways:

Passive Income Source: Monthly earnings can range from $150 to $300 per machine.

Additional Services: Mobile top-ups and bill payments can provide extra revenue.

Strategic Location Benefits: Place in high-traffic areas for maximum footfall and income.

Low Maintenance: Minimal hands-on upkeep once established.

Tax Advantages: Depreciation offers potential tax benefits.

I am Lydia Valberg, with a deep lineage in the payment industry. With a passion for marrying tradition and innovation, I guide businesses through strategic ventures like investing in ATM machine opportunities. Join me as we explore how ATMs can lift your business.

Understanding ATM Investments

ATM investments offer a unique blend of low-risk and high-return opportunities, making them an attractive option for many investors. Let's break down why this is the case.

Low-Risk Investment

Investing in ATMs is considered relatively low-risk compared to other investment options like stocks or real estate. This is because ATMs are non-correlated assets, meaning they don't fluctuate with the traditional markets. Even during economic downturns, people still need cash, making ATMs a stable choice.

High Return

The potential for high returns is a major draw for ATM investments. ATMs generate income through transaction fees, typically ranging from $2 to $3 per transaction. With a consistent volume of transactions, especially in high-traffic locations, the cash flow can be substantial.

Passive Profits

One of the most appealing aspects of ATM investments is the passive income they provide. Once an ATM is installed and operational, it requires minimal maintenance. The funds disbursed by the ATM are electronically transferred back to your account within 24 to 48 hours, recycling your money daily. This setup allows you to earn profits without ongoing effort.

Key Benefits at a Glance

Consistent Cash Flow: Reliable income from transaction fees.

Recession-Resilient: Non-correlated asset that remains stable during economic shifts.

Tax Advantages: Depreciation offers potential tax benefits due to the shorter lifespan of ATMs compared to real estate.

Minimal Maintenance: Little hands-on involvement required once set up.

With these benefits in mind, it's clear why investing in ATM machines is gaining popularity among investors looking for a solid and steady return.

Transitioning into the next section, let's explore how you can start investing in ATM machines, covering essential topics like initial costs, location selection, and surcharge fees.

How to Start Investing in ATM Machines

Starting an ATM investment can be a straightforward process if you know what steps to take. Let's explore the key elements you need to consider: initial costs, location selection, and surcharge fees.

Initial Costs

Investing in an ATM machine involves a few upfront expenses. Here's what you need to budget for:

ATM Machine Purchase: New machines typically cost between $2,000 and $5,000. While buying used equipment might seem cheaper, it's risky. Used machines can be outdated or prone to breakdowns, leading to higher maintenance costs.

Installation and Setup: Expect to pay for installation and any necessary network connections. This can vary based on location and complexity.

Working Capital: You'll need cash to load into the machine. Plan for at least $2,000 per week per ATM to keep it operational.

Location Selection

Choosing the right location is crucial for maximizing your ATM's profitability. Here are some tips:

High Foot Traffic Areas: Look for spots with lots of people, like malls, convenience stores, and busy streets. More visitors mean more transactions.

Business Partnerships: Consider partnering with local businesses. An ATM can attract more customers to their store, benefiting both parties.

Safety and Security: Ensure the location is safe and well-lit to encourage use and deter vandalism.

Surcharge Fees

Surcharge fees are your main source of income from ATMs. Setting them correctly is vital:

Market Research: Understand the typical surcharge fees in your area. You want to be competitive but also make a profit.

Negotiation with Merchants: When placing your ATM in a business, you'll need to negotiate how surcharge fees are shared. This can affect your overall earnings.

Flexibility: Be prepared to adjust fees based on location performance and customer feedback.

By understanding these key aspects, you can make informed decisions and set up a successful ATM investment. In the next section, we'll explore the benefits of owning an ATM, including how they can increase foot traffic and share surcharge revenue with business partners.

Benefits of Owning an ATM

Owning an ATM can be a profitable venture with multiple benefits. Let's explore some key advantages: customer attraction, increased foot traffic, and shared surcharge revenue.

Customer Attraction

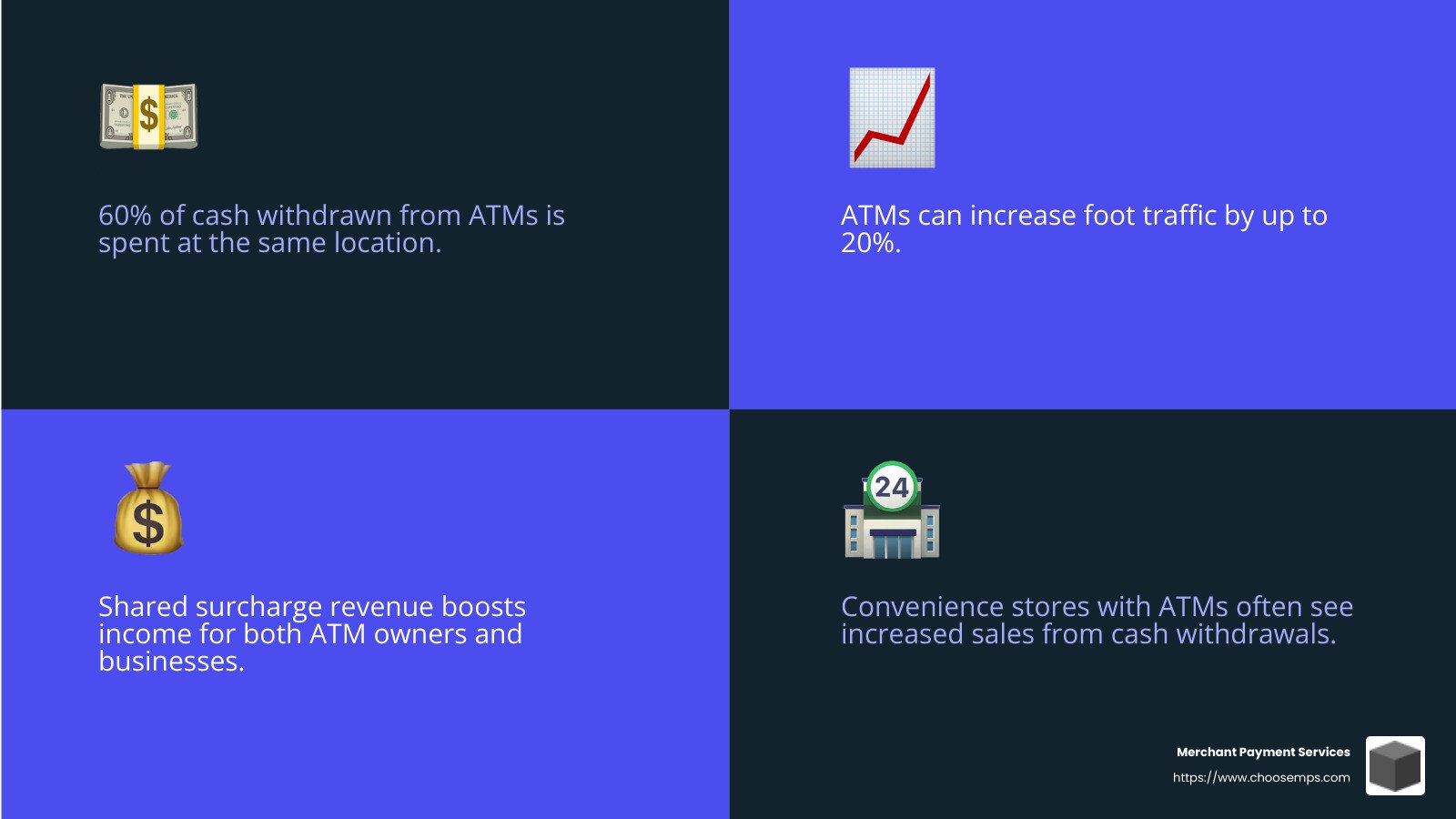

ATMs are a magnet for customers. People often need quick access to cash, and having an ATM nearby makes your business a convenient stop. This convenience can draw more people to your location, boosting your visibility and reputation.

Convenience Stores: These are prime spots for ATMs. Customers stopping for cash may also purchase other items, increasing overall sales.

Entertainment Venues: Places like concert halls and amusement parks benefit greatly, as attendees often need cash for tickets or concessions.

Increased Foot Traffic

An ATM can significantly increase foot traffic to your business. More visitors mean more potential sales, not just for the ATM but for your entire store.

Bars and Nightclubs: Patrons often need cash for cover charges or tips, making ATMs a valuable addition.

Hotels: Guests appreciate the convenience of an on-site ATM, especially when traveling.

Strip Clubs: These establishments see high demand for cash, making ATMs a profitable addition.

Shared Surcharge Revenue

One of the most appealing aspects of owning an ATM is the surcharge revenue. Every time someone withdraws cash, you earn a fee, which can add up quickly.

Partnerships with Businesses: By placing your ATM in a local business, you can negotiate a shared surcharge revenue. This setup benefits both parties—businesses get more customers, and you get a steady income stream.

Daily Cash Recycling: Funds withdrawn are electronically transferred to your account within 24 to 48 hours, ensuring a continuous flow of cash and profits.

In summary, owning an ATM can improve your business by attracting more customers, increasing foot traffic, and generating revenue through surcharge fees. These benefits make investing in ATM machines a compelling opportunity. Next, we'll discuss common mistakes to avoid in ATM investments.

Common Mistakes to Avoid in ATM Investments

When investing in ATM machines, it's important to steer clear of common pitfalls. Let's dig into some mistakes that new investors often make:

Overestimating Income

Many people assume ATMs will bring in high profits right from the start. While some sources suggest earnings of $500 per month per machine, it's wiser to be conservative. Realistically, you might see $150-$300 monthly, depending on location and usage. Always do your homework and talk to business owners to get a clearer picture of potential income.

Used Equipment Risks

Buying used ATMs can be tempting due to lower costs, but it often leads to trouble. Older machines might not meet current EMV standards, which are vital for security. Investing in new machines not only ensures compliance but also comes with warranties that can save you from costly repairs. A machine that frequently breaks down can lose its spot in a high-traffic area.

Capital Requirements

Another mistake is underestimating the cash needed to keep ATMs operational. Each machine typically requires $2,000 to $5,000 in cash for daily transactions. If you plan to operate multiple machines, ensure you have enough working capital to keep them stocked. Lack of cash can lead to downtime, which means lost revenue opportunities.

By avoiding these common mistakes, you can set a solid foundation for your ATM investment journey. Next, we'll address frequently asked questions about investing in ATM machines.

Frequently Asked Questions about Investing in ATM Machines

Are ATM machines good investments?

ATM machines can be a safe investment if approached wisely. They offer a low-risk opportunity to earn passive income, primarily due to the consistent demand for cash withdrawals. The key is selecting high-traffic locations like malls, convenience stores, or near entertainment venues, where there's a steady flow of potential users. This ensures a stable transaction volume, translating to reliable income.

How much does it cost to invest in an ATM machine?

The cost of investing in an ATM machine can vary. Typically, a new machine might range from $2,000 to $10,000. Factors affecting the cost include the machine's features, brand, and whether it’s new or used. While used machines might seem cheaper, they're often not up-to-date with essential security standards like EMV compliance. Investing in a new machine can save future headaches and ensure smoother operations.

How much money do you make owning an ATM?

The potential income from owning an ATM largely depends on its location and the surcharge fees set. On average, surcharge fees range from $2.50 to $3.50 per transaction. If your machine is in a busy area and gets used frequently, you could earn between $150 and $300 per month. However, this can vary. Talking to other business owners and researching high-traffic spots can help maximize your earnings.

Conclusion

Merchant Payment Services offers a comprehensive approach to investing in ATM machines, providing businesses with a strategic path to financial growth. By leveraging our expertise in payment processing solutions, you can tap into the lucrative world of ATM investments with confidence.

Our unique selling proposition includes risk-free, month-to-month agreements and no hidden fees, ensuring transparency and integrity in every transaction. With our support, businesses across various locations can improve their cash flow and attract more foot traffic by strategically placing ATMs in optimal spots. This not only boosts the business's revenue through shared surcharge fees but also improves customer satisfaction by providing convenient access to cash.

Choosing to invest in ATMs with Merchant Payment Services means you are not just buying a machine; you are gaining a partner committed to your financial success. Our solutions are designed to be hassle-free, allowing you to focus on growing your business while we handle the intricacies of ATM operations.

For those ready to explore the potential of ATM investments and achieve financial growth, we invite you to find more about our ATM services. Together, we can turn your investment into a thriving source of passive income.