What Are Digital Payment Systems and How Do They Work?

The Rise of Digital Payment Systems

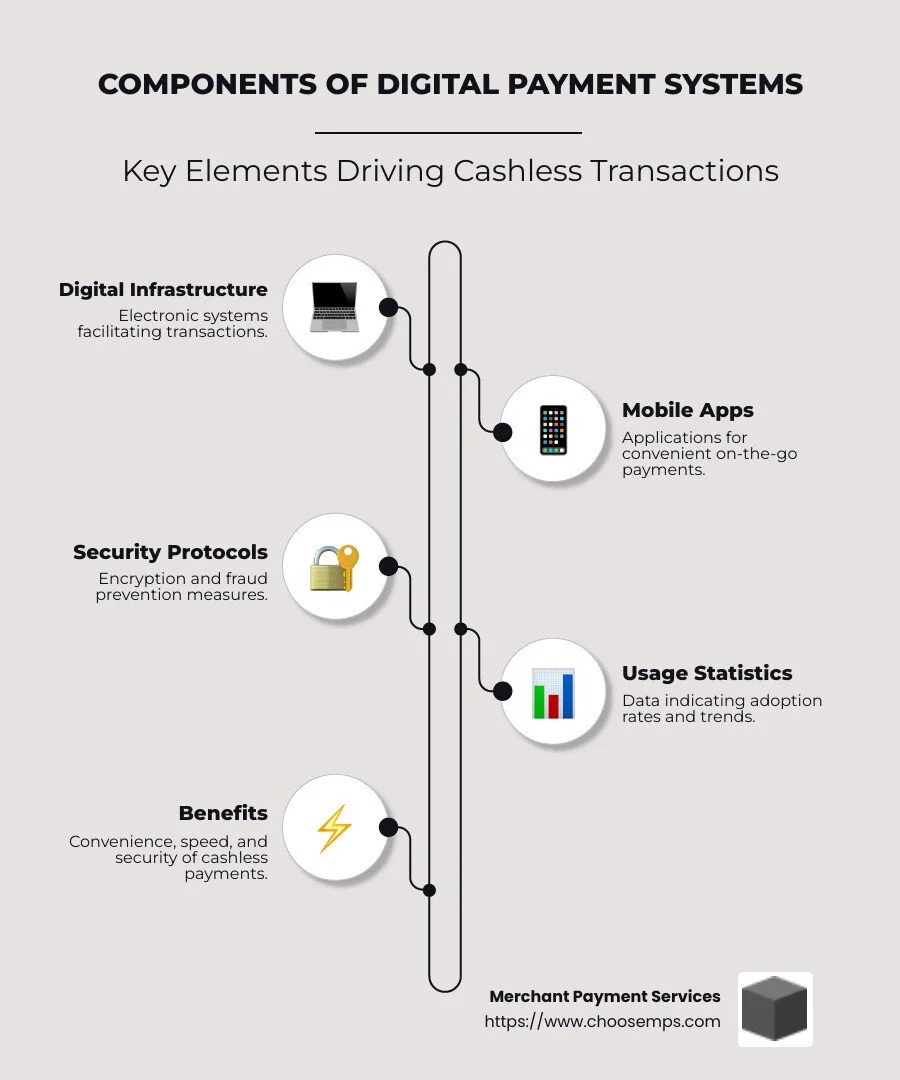

Digital payment systems are changing the way we handle money today. They allow consumers to make transactions without using cash, instead relying on digital or electronic mechanisms. If you're looking for a quick understanding:

Digital Payments refer to the use of digital methods, like mobile payments and e-wallets, to complete transactions.

Electronic Payment Systems are infrastructures that facilitate these payments.

Cashless Transactions remove the need for physical money, making payments quicker and often more secure.

Businesses are increasingly adopting these systems to streamline operations and meet evolving consumer expectations. The pandemic further accelerated the transition towards a cashless society, making digital payment systems an integral part of our financial landscape.

As Roman Hildebrandt, Senior Vice President at SunTrust, notes, digital money movement solutions, such as Zelle, cater to all generations, highlighting the flexibility and widespread appeal of these systems.

I’m Lydia Valberg, co-owner of Merchant Payment Services, with an background in fostering trustworthy, transparent business practices. My experience in managing digital payment systems has taught me the importance of adapting to customer needs while maintaining integrity and innovation as core values.

Understanding Digital Payment Systems

Digital payment systems are modern tools that let you pay for things without using cash. They use electronic methods to make transactions fast, easy, and secure.

Types of Digital Payment Systems

1. Credit/Debit Cards

Credit and debit cards are one of the most common forms of digital payments. A debit card lets you spend money directly from your bank account, while a credit card allows you to borrow money from the card issuer up to a certain limit. These cards are widely accepted at both physical stores and online.

2. Bank Transfers

Bank transfers involve moving money directly from one bank account to another. This method is often used for paying bills or sending money to friends and family. It's a secure way to transfer funds, but it may take a little longer than other digital payment methods.

3. E-Wallets

E-wallets, or electronic wallets, store your payment information on a digital device, like a smartphone. Popular e-wallets include apps like Apple Pay and Google Pay. They offer a convenient way to pay for purchases by simply tapping your phone at a payment terminal.

4. Mobile Payments

Mobile payments use your smartphone to make transactions. This can include using an app to pay for goods and services or transferring money to another person. Mobile payments are growing in popularity due to their convenience and speed.

5. Online Banking

Online banking allows you to manage your bank account over the internet. You can check your balance, transfer money, and pay bills without visiting a bank branch. It's a secure and efficient way to handle your finances.

Digital payment systems rely on digital devices like smartphones, tablets, and computers. These devices connect to your payment account, which is a secure place where your money is stored or managed. Whether you're using a credit card or an e-wallet, these systems make it easy to complete transactions with just a few taps or clicks.

Benefits of Digital Payment Systems

In today's world, digital payment systems offer numerous advantages that make them an attractive choice for both consumers and businesses. Let's explore the key benefits: convenience, speed, and security features.

Convenience

One of the biggest perks of digital payments is their convenience. No more carrying around cash or writing checks. With digital payment systems, you can make transactions anywhere, anytime, using just your smartphone or computer. Whether you're shopping online, splitting a bill with friends, or paying for a service, digital payments simplify the process.

For instance, mobile wallets like Apple Pay and Google Pay allow you to store your payment information on your device. This means you can pay with just a tap at participating retailers, saving you time and hassle.

Speed

Digital payments are not only convenient but also incredibly fast. They eliminate the need to count cash or wait for change. With just a few clicks or taps, transactions are completed almost instantly. This speed is beneficial for both consumers and businesses, as it reduces wait times and improves the overall shopping experience.

Security Features

Security is a top priority when it comes to handling money. Digital payment systems are equipped with advanced security features to protect your information. These include encryption and multi-factor authentication, which help keep your personal and financial data safe from unauthorized access.

For example, mobile wallets often use tokenization, replacing sensitive card information with a unique code for each transaction. This means your actual card details are never shared, adding an extra layer of protection.

In summary, digital payment systems offer a seamless blend of convenience, speed, and robust security, making them an ideal choice for modern transactions. With these benefits, it's no wonder they're becoming the preferred payment method for many.

Popular Digital Payment Methods

Digital payment systems have transformed the way we handle money. Let's explore some of the most popular methods people use today.

Credit and Debit Cards

Credit and debit cards are perhaps the most familiar forms of digital payments. They allow for quick and easy transactions, whether you're in a store or shopping online.

Debit Cards: These cards draw money directly from your bank account. They’re great for managing spending since you can only use what's available in your account.

Credit Cards: These offer a line of credit from the card issuer. You can make purchases and pay off the balance over time, often with interest.

Many cards now include contactless payment technology, allowing you to simply tap your card on a terminal for an even faster checkout experience.

Bank Transfers

Bank transfers are another common digital payment method. They allow you to move money directly from one bank account to another. This method is often used for paying bills or transferring large sums of money.

Direct Transfers: Initiated through your bank's online platform, making it a secure option for sending funds.

Automated Clearing House (ACH) Transfers: Used for recurring payments like subscription services or salary deposits.

E-Wallets

E-wallets are digital versions of your physical wallet. They store your payment information securely so you can make transactions without needing your card on hand.

Examples: Apple Pay, Google Pay, and Samsung Pay are popular e-wallets that allow you to pay with your smartphone or smartwatch.

E-wallets often come with added security features like encryption and tokenization, making them a safe choice for digital payments.

Mobile Payments

Mobile payments are transactions made using your smartphone. They can be done through mobile apps or by tapping your phone at a payment terminal.

Peer-to-Peer (P2P) Apps: Apps like Venmo and Cash App let you send money to friends or family with just their phone number or email address.

Mobile Wallets: As mentioned earlier, these allow for contactless payments at various retailers.

Online Banking

Online banking allows you to manage your finances from your computer or mobile device. You can check balances, transfer money, and pay bills without visiting a bank branch.

Convenience: Access your account anytime, anywhere.

Security: Banks use strong encryption and security measures to protect your data.

These digital payment systems offer a variety of ways to manage and spend your money efficiently and securely. Each method has its own advantages, making it easy to find one that suits your needs.

How Digital Payment Systems Work

Understanding how digital payment systems work can help you make the most of their convenience and security.

Mobile Wallets

Mobile wallets store your payment information securely on your smartphone. They allow you to make contactless payments by simply tapping your phone at a payment terminal. This method is not only fast but also secure, thanks to encryption and tokenization techniques that protect your data.

Peer-to-Peer Payments

Peer-to-peer (P2P) payment apps make it easy to send money to friends and family. All you need is the recipient's phone number or email address. These apps use strong encryption and authentication processes to ensure your transactions are secure and private.

Online Shopping

When shopping online, digital payment systems enable you to pay for goods and services without needing cash or checks. Whether using a credit card, debit card, or e-wallet, online transactions are protected with encryption and multiple layers of authentication to safeguard your information.

Security Measures in Digital Payments

Security is a top priority in digital payment systems. Here are some key measures in place to protect your transactions:

Encryption: This technology scrambles your data during transmission, ensuring only authorized parties can read it.

Authentication: Multi-factor authentication (MFA) adds an extra layer of security. It requires you to verify your identity through additional steps, like entering a code sent to your phone.

Fraud Prevention: Advanced algorithms and monitoring systems detect suspicious activity, helping prevent unauthorized transactions and reducing the risk of fraud.

These security measures work together to create a safe environment for digital transactions, giving you peace of mind when using digital payment systems.

Frequently Asked Questions about Digital Payment Systems

What is a digital payment system?

A digital payment system allows you to transfer money electronically without using cash or checks. These systems use digital devices like smartphones, computers, or tablets to facilitate transactions. Whether you're paying for groceries, splitting a bill with friends, or shopping online, digital payment systems make it quick and easy.

Which is the best digital payment system?

The "best" digital payment system depends on your needs and preferences. Some popular options include:

Mobile Wallets: Ideal for contactless payments at stores.

Peer-to-Peer Payment Apps: Great for sending money to friends and family.

Online Payment Platforms: Perfect for shopping online.

Consider factors like ease of use, security features, and where you plan to use the system to decide which is best for you.

Is PayPal a digital payment system?

Yes, PayPal is a widely recognized digital payment system. It allows users to send and receive money online, pay for goods and services, and even transfer funds to bank accounts. PayPal offers strong security measures, including encryption and buyer protection, making it a reliable choice for many users.

Conclusion

As we look to the future, digital payment systems are set to redefine how we think about money and transactions. The world is moving towards a cashless society, where convenience, speed, and security are paramount. At Merchant Payment Services, we are committed to being at the forefront of this change. Our offerings, including free terminals and mobile payment options, make it easy for businesses to adapt to this new era without the burden of startup or hidden fees.

The rise of digital transactions is not just a trend—it's a revolution. With the increasing adoption of mobile wallets, peer-to-peer payments, and online shopping, businesses and consumers alike are enjoying unprecedented ease and flexibility in managing their finances. Our services are custom to help you steer this landscape smoothly, ensuring that your business stays competitive and your customers remain satisfied.

For businesses looking to accept the future of money, Merchant Payment Services provides the tools and support needed to succeed. Whether you're in Chicago, Fresno, or Providence, our solutions are designed to simplify your payment processing and improve your operations.

Explore how we can help your business thrive in the digital age by visiting our mobile payment solutions page.

In this changing world, the question isn't whether digital payments will dominate but rather how quickly you can adapt and benefit from them. Join us as we continue to innovate and lead the charge in this exciting financial frontier.