Crafting the Perfect Payment: Custom Solutions for Your Business

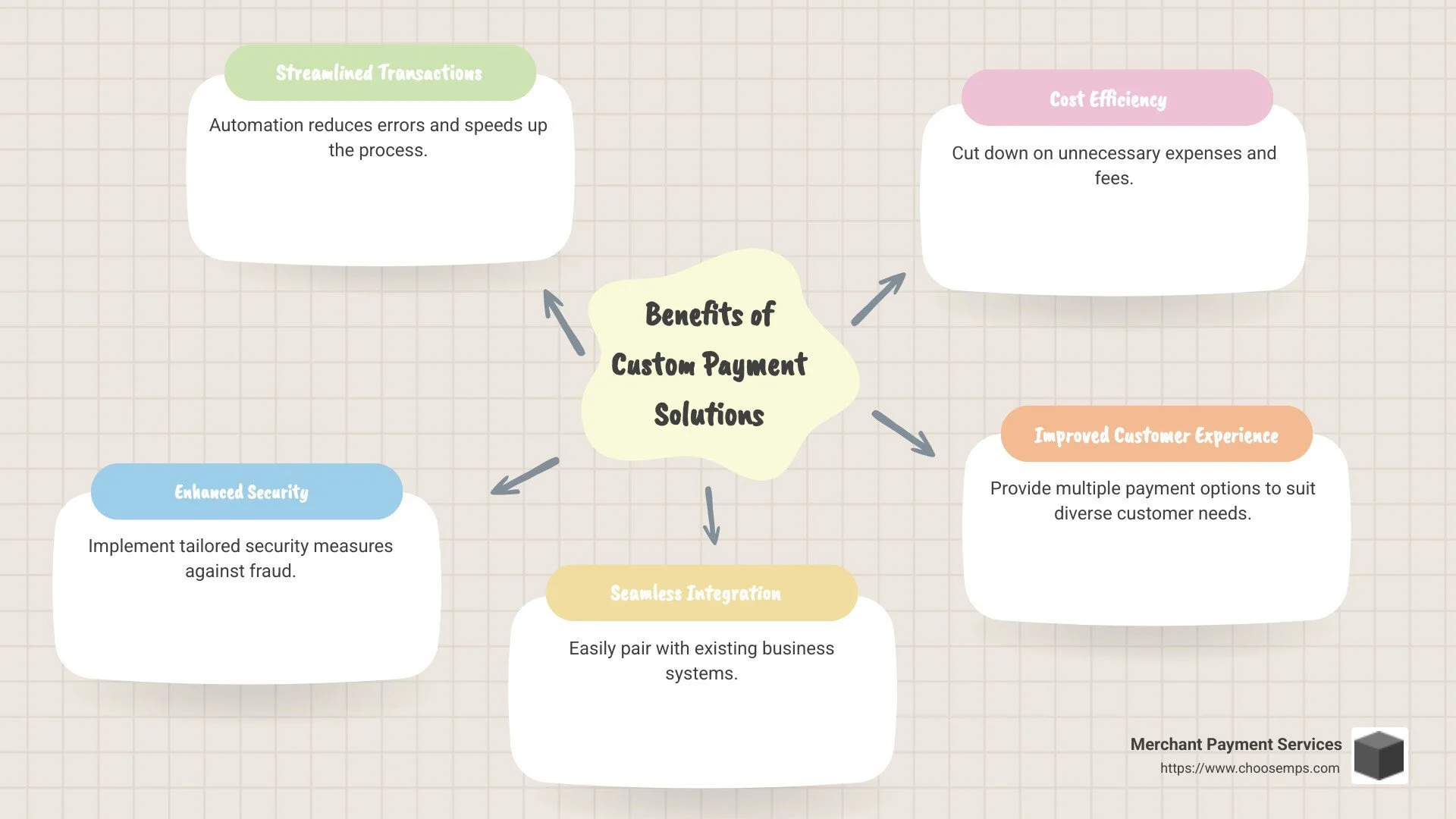

Custom payment solutions are revolutionizing how businesses manage transactions. For small retailers dealing with high fees or business owners concerned about security, a custom solution offers numerous advantages:

Streamlined Transactions: Automation minimizes errors and accelerates the process.

Enhanced Security: Implement tailored security measures to combat fraud.

Seamless Integration: Easily integrate with existing business systems.

Cost Efficiency: Reduce unnecessary expenses and fees.

Improved Customer Experience: Offer multiple payment options to meet diverse customer needs.

In today's competitive market, delivering secure and efficient transactions can distinguish your business. Custom payment solutions enable you to tailor every aspect of the transaction process, making it more adaptable to your unique business needs.

As a dedicated custodian of tradition at Merchant Payment Services, I'm Lydia Valberg. I bring decades of experience in fostering secure, custom payment systems, ensuring each solution is deeply aligned with our clients’ needs. Let's explore this transformative world of custom payment solutions.

Understanding Payment Gateways and Processors

When you initiate a payment, whether by swiping your card or clicking "buy now," a sophisticated technological process ensures your payment is processed securely and efficiently. This involves two critical components: the payment gateway and the payment processor.

How Payment Gateways Work

A payment gateway serves as a digital intermediary that safely transmits your payment information to the payment processor. It acts as the bridge connecting the customer to the financial networks involved in the transaction.

Here's a simplified overview of the process:

Encryption: The gateway encrypts your payment details to protect sensitive information like credit card numbers.

Authorization Requests: It then forwards these encrypted details to the payment processor, which verifies with the card network whether the transaction should be approved.

Filling the Order: Post-approval, the gateway notifies the business to proceed with order fulfillment. If declined, the gateway promptly informs the customer.

Settlement: Finally, all approved transactions are batched and sent to the bank for settlement, culminating in the deposit of funds into the business's account.

How Payment Processors Work

The payment processor operates behind the scenes, acting as the powerhouse that drives the transaction from inception to completion.

Here's the breakdown:

Authorization: It confirms the validity of your card and checks for sufficient funds.

Transaction Processing: Once authorized, it facilitates the movement of transaction data to the issuing bank, a critical step for transferring funds from the customer's to the merchant's account.

Payment: The processor finally transfers the funds, completing the transaction and ensuring the business receives payment.

Understanding these components helps businesses appreciate how custom payment solutions can enhance control, security, and efficiency in their transaction processes.

Benefits of Custom Payment Solutions

When it comes to handling payments, custom payment solutions offer a host of advantages that can significantly impact your business's success. Let's explore how customization, cost savings, and improved customer experience come into play.

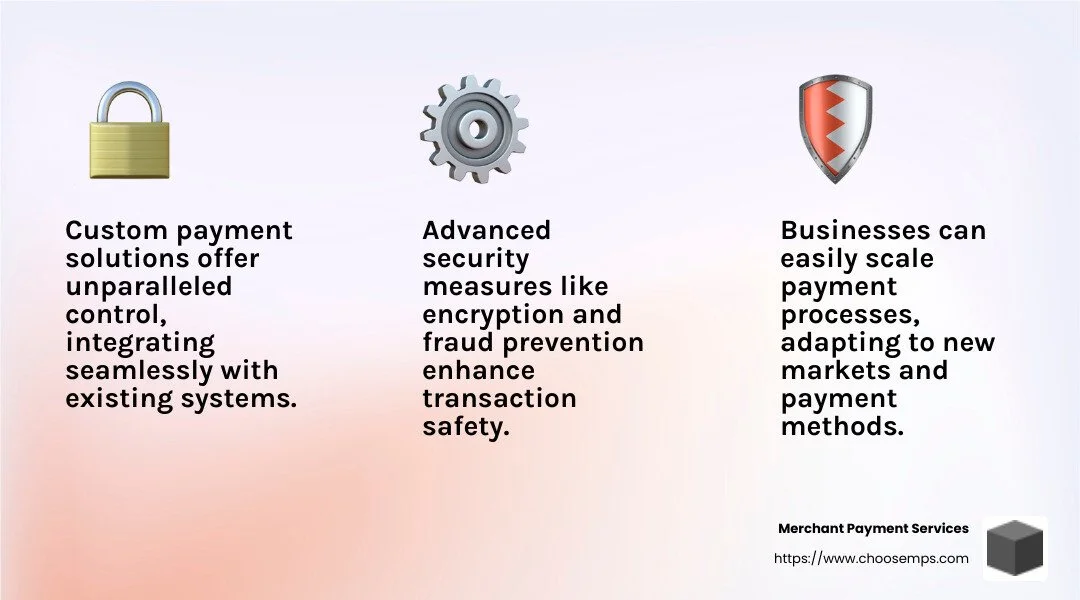

Improved Control and Flexibility

Custom payment solutions put you in the driver's seat. They give you unparalleled control over your payment processes, allowing you to tailor every aspect to fit your unique business needs. This means seamless integration with your existing systems, whether it's your CRM, ERP, or e-commerce platform.

With custom solutions, you can easily scale your payment processes as your business grows. Whether you're expanding into new markets or adding new payment methods, the flexibility of a custom solution ensures you're always ready to adapt.

Improved Security and Compliance

Security is paramount in payment processing. Custom solutions allow you to implement advanced security measures like encryption and fraud prevention custom to your specific requirements. By adhering to PCI DSS standards, you ensure that all transactions are secure, fostering trust among your customers.

Fraud prevention systems can be customized to monitor transactions in real time, catching suspicious activity before it becomes a problem. This level of security not only protects your business but also improves the customer experience by providing a safe shopping environment.

Cost Savings

While the initial investment in a custom solution may seem daunting, the long-term savings are substantial. Custom solutions reduce reliance on third-party providers, leading to lower transaction fees. Plus, the efficiency gained from streamlined processes means less time and resources spent on manual tasks.

By optimizing your payment system, you reduce errors and operational costs, resulting in significant savings over time.

Improved Customer Experience

A smooth payment experience is crucial for customer satisfaction. Custom solutions allow you to offer a variety of payment options, catering to diverse customer preferences. This flexibility can lead to higher conversion rates and repeat business.

With custom solutions, you can also provide real-time transaction updates, ensuring customers are informed every step of the way. This transparency builds trust and encourages loyalty.

In conclusion, custom payment solutions offer businesses improved control, improved security, cost savings, and a better customer experience. By tailoring your payment processes to your specific needs, you can open up new opportunities for growth and success.

Next, we'll explore the challenges involved in developing these custom solutions and how to overcome them effectively.

Challenges in Developing Custom Payment Solutions

Creating custom payment solutions is no small feat. It involves a range of challenges that require careful planning and execution. To help you steer this complex landscape, let's break down the main problems and how to overcome them.

Overcoming Technical Barriers

Compliance Requirements

When building a payment solution, compliance is a top priority. You'll need to adhere to standards like PCI DSS to ensure your system is secure and trustworthy. This involves regular audits and updates to meet evolving regulations. While this can be time-consuming, it is crucial for protecting sensitive customer data and maintaining trust.

Security Concerns

Security is at the heart of any payment solution. Implementing robust security measures like encryption and fraud detection is essential. Custom solutions allow you to tailor these measures to your specific needs, providing a higher level of protection. However, keeping up with new threats requires ongoing vigilance and investment.

Technical Expertise

Developing a custom payment solution requires a team with deep technical knowledge. Your developers should be skilled in software development and familiar with the intricacies of payment processing. This includes integrating with multiple banking APIs and ensuring seamless operation across various platforms. Building such a team can be challenging, but it's essential for success.

Software Development

The software development process is complex and requires meticulous planning. You'll need to design, test, and deploy your solution, ensuring it functions smoothly and securely. Regular updates and maintenance are also necessary to keep your system running optimally. This ongoing commitment can be resource-intensive but is vital for long-term success.

Financial Partnerships

Establishing relationships with financial institutions is another challenge. These partnerships are crucial for processing payments and often involve navigating complex agreements. Building a network of reliable partners can be difficult, especially for smaller businesses, but it's a key step in creating a successful payment solution.

Maintenance

Even after your payment solution is up and running, the work doesn't stop. Regular maintenance is needed to address any issues and keep the system updated with the latest security features and compliance requirements. Providing customer support is also essential to ensure a smooth user experience. This ongoing effort can be a significant resource drain, but it's necessary for maintaining a robust and reliable system.

In summary, developing custom payment solutions involves overcoming technical barriers, ensuring compliance, and maintaining strong security. With the right team and strategy, you can tackle these challenges and create a solution that meets your business needs.

Next, we'll dig into the steps required to build your own payment gateway, from planning to deployment.

How to Create Your Own Payment Gateway

Steps to Build a Payment Gateway

Building a payment gateway is like constructing a skyscraper—it requires a solid foundation, precise planning, and expert execution. Here's a step-by-step guide to help you steer this complex process.

1. Planning

Start by clearly defining your business requirements. Identify your target audience, expected transaction volumes, and the payment methods and currencies you want to support. This stage is crucial because it sets the direction for your entire project.

2. Compliance and Security

Next, ensure your payment gateway complies with all relevant financial regulations. This includes adhering to PCI DSS standards, which protect sensitive cardholder data. You'll need to obtain certifications and conduct regular audits to maintain compliance. Implementing robust security measures like encryption and fraud detection will also safeguard your system against threats.

3. Building Relationships with Financial Institutions

Your payment gateway needs to integrate with banks and credit card companies. This requires forming partnerships with these institutions, which can involve lengthy negotiations and complex agreements. Establishing these relationships is essential for processing payments smoothly.

4. Software Development

With your plans and partnerships in place, it's time to develop the software. Hire a team of experienced developers who can steer the intricacies of payment processing. They should be skilled in integrating multiple banking APIs and ensuring seamless operation across various platforms. This stage is resource-intensive but critical for creating a functional gateway.

5. Testing

Once the software is developed, it needs rigorous testing. Ensure it can handle the transaction volumes you anticipate and works as expected. Identify and resolve any bugs or issues that arise during this phase. Thorough testing ensures your gateway is reliable and ready for deployment.

6. Deployment and Maintenance

After successful testing, deploy your payment gateway. But remember, your work doesn't end here. Regular maintenance is necessary to keep the system updated with the latest security features and compliance requirements. Provide customer support to ensure a smooth user experience. This ongoing effort is vital for maintaining a robust and reliable gateway.

Building your own payment gateway is a challenging but rewarding endeavor. By following these steps, you can create a solution that aligns with your business goals and provides a seamless payment experience for your customers.

Next, we'll explore the frequently asked questions about custom payment solutions, addressing common concerns and providing insights into their benefits and challenges.

Frequently Asked Questions about Custom Payment Solutions

What are the benefits of custom payment solutions?

Custom payment solutions offer several advantages that can significantly improve your business operations:

Personalization: Tailor your payment system to fit your specific business needs. This means integrating with your existing platforms, such as CRM or ERP systems, for a seamless experience.

Cost Savings: By customizing your payment process, you can reduce transaction fees and avoid unnecessary features that come with off-the-shelf solutions. This can lead to substantial savings over time.

Customer Experience: Improve the checkout process with a user-friendly interface that reflects your brand. Offering various payment methods and ensuring quick, secure transactions can boost customer satisfaction and loyalty.

Scalability: As your business grows, your payment solution can evolve with you. Custom systems can be scaled to handle increased transaction volumes, ensuring smooth operations at all times.

How do custom payment solutions improve security?

Security is a top priority for any payment processing system. Here's how custom payment solutions improve security:

PCI DSS Compliance: Custom solutions can be designed to meet PCI DSS standards, ensuring that cardholder data is protected according to the latest security protocols.

Advanced Encryption: Implement strong encryption methods to safeguard sensitive information during transactions. This helps prevent data breaches and unauthorized access.

Fraud Prevention: Customize your system with fraud detection tools that monitor transactions in real time. These tools can identify unusual patterns and stop fraudulent activity before it impacts your business.

What are the challenges in developing a custom payment gateway?

Creating a custom payment gateway is a complex task with several challenges:

Compliance Requirements: Navigating financial regulations and ensuring compliance with standards like PCI DSS can be daunting. This involves obtaining certifications and conducting regular audits.

Security Concerns: Developing a secure payment system requires implementing robust security measures to protect against cyber threats. This includes encryption, tokenization, and continuous monitoring for vulnerabilities.

Technical Expertise: Building a payment gateway demands significant technical knowledge. You need a skilled development team to handle software integration, API management, and system maintenance.

Financial Partnerships: Establishing relationships with banks and credit card companies is essential for processing payments. This can involve lengthy negotiations and complex contractual agreements.

By understanding these challenges and benefits, businesses can make informed decisions about implementing custom payment solutions that align with their unique needs and goals.

Conclusion

As we've explored, custom payment solutions offer a significant edge for businesses looking to improve their payment processes. At Merchant Payment Services, we understand the importance of crafting payment systems that are not only efficient but also custom to meet the unique demands of your business.

Our solutions provide the flexibility and control you need to manage your payments effectively. By opting for a customized approach, you can ensure that your payment processing aligns perfectly with your business model, offering seamless integration with existing systems.

Business growth is at the heart of what we do. With our risk-free, month-to-month agreements and no hidden fees, we make it easier for you to focus on expanding your operations without worrying about unnecessary costs. Our solutions are designed to scale alongside your business, ensuring that as your transaction volumes increase, your systems remain robust and reliable.

Moreover, security and compliance are non-negotiable in today's digital landscape. Our custom payment solutions adhere to stringent security standards, including PCI DSS compliance, offering peace of mind that your transactions are protected against fraud and data breaches.

Choosing Merchant Payment Services means partnering with a provider that values exceptional service and integrity. We're committed to helping you open up new opportunities for success with solutions that are as unique as your business.

Explore how our online payment processing services can empower your business to thrive in the digital economy. Contact us today to learn more about how we can support your growth with custom payment solutions custom to your needs.