Advanced Transaction Processing: A Comprehensive Guide

Advanced transaction processing is essential for small retail business owners who need a reliable and efficient way to handle transactions. In simple terms, advanced transaction processing refers to managing multiple tasks at once to ensure seamless customer service. For small businesses, this means faster checkouts, better record-keeping, and fewer errors in both in-store and online sales.

Here are the key points you need to know about advanced transaction processing:

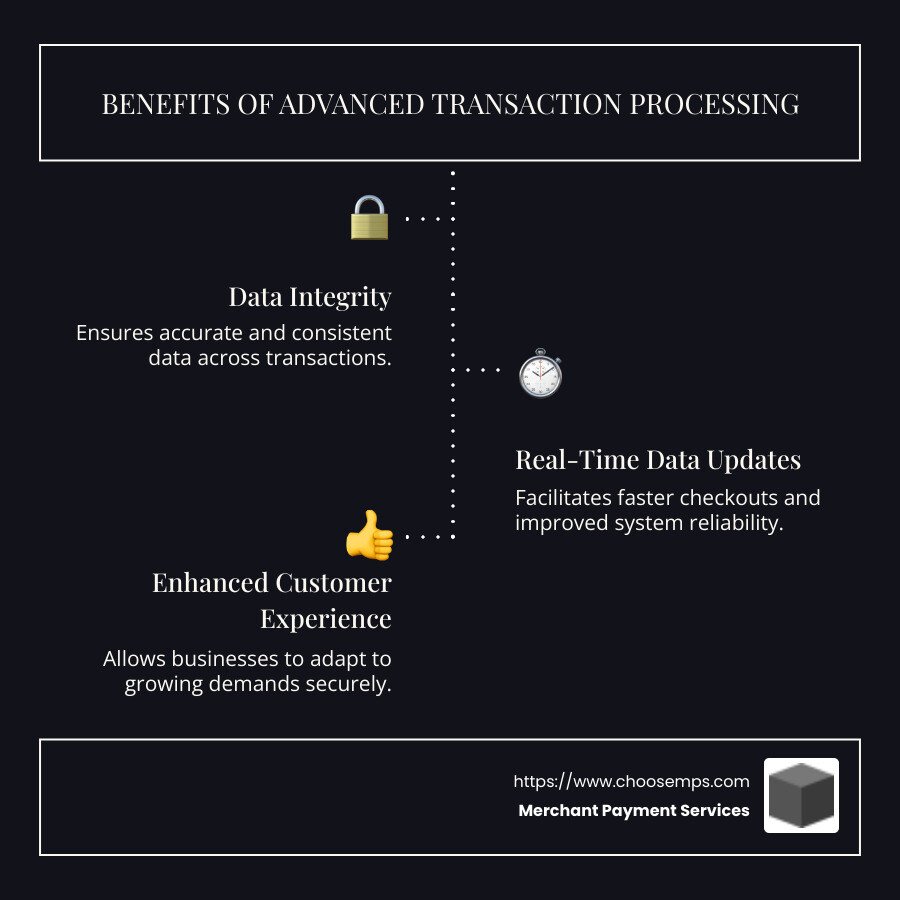

It ensures data integrity by making certain all data is accurate and consistent.

It's integral to database systems, providing the backbone for secure and efficient transaction handling.

Businesses can benefit significantly from its features, such as real-time data updates, increased transaction speed, and improved system reliability.

Incorporating advanced transaction processing allows businesses to provide better customer experiences and adapt to growing demands without compromising security or flexibility.

My name is Lydia Valberg, and at Merchant Payment Services, I've dedicated myself to offering transparent payment solutions that are both secure and flexible. With a background steeped in family tradition, I continue to uphold the standards of trust and integrity in bringing advanced transaction processing solutions to small business owners.

Understanding Advanced Transaction Processing

Advanced transaction processing is at the heart of modern business operations, especially in sectors like retail and e-commerce. It ensures that every transaction is handled smoothly and efficiently, which is crucial for maintaining customer satisfaction.

Transaction Processing

At its core, transaction processing involves a series of operations that manage data changes in a database. Imagine you’re transferring money between bank accounts. This process involves debiting one account and crediting another. If one step fails, the entire transaction might be rolled back to maintain data integrity. This ensures that the system remains consistent and reliable.

Online Transaction Processing (OLTP)

OLTP is a category of software applications that support transaction-oriented tasks. It’s designed to handle a large number of transactions by many users at the same time. This is crucial for businesses like online retailers or banks, where multiple transactions occur simultaneously. For example, when you buy something online, OLTP systems ensure that your order is processed, your payment is accepted, and your inventory is updated—all in real time.

Database Operations

Advanced transaction processing is built on complex database operations. These operations include:

Read and Write Operations: Accessing and updating data efficiently.

Consistency Checks: Ensuring that all database changes are valid and follow predefined rules.

Concurrency Control: Managing multiple transactions at the same time without conflicts.

These operations are essential for maintaining the performance and reliability of transaction systems. They ensure that businesses can handle high volumes of transactions without errors.

In summary, advanced transaction processing is not just about speed. It's about accuracy, reliability, and ensuring that every transaction is completed successfully. By leveraging OLTP and robust database operations, businesses can provide seamless experiences for their customers, whether they're shopping online or in-store.

Key Components of Advanced Transaction Processing

When it comes to advanced transaction processing, there are a few key components that ensure everything runs smoothly and reliably. These components are crucial for maintaining the integrity and efficiency of database systems, especially in high-demand environments like online banking and retail.

ACID Properties

The ACID properties are the backbone of transaction processing. They ensure that transactions are processed reliably and help maintain data integrity. Here's a quick look at what each property means:

Atomicity: This means that a transaction is all-or-nothing. If any part of the transaction fails, the entire transaction is aborted, and the database returns to its previous state. Think of it like a light switch—it's either on or off, with no in-between.

Consistency: Transactions must transition the database from one valid state to another. This ensures that any data written to the database must be valid according to all defined rules, including constraints and triggers.

Isolation: Even if transactions are happening at the same time, one transaction should not affect another. This is like working in a quiet library where everyone is focused on their own work without distractions.

Durability: Once a transaction is committed, it stays committed, even if there is a system failure. This ensures that all changes made by a transaction are permanently saved.

Transaction States

Transactions go through several states from start to finish. Understanding these states helps in managing and troubleshooting transactions:

Active: The transaction is currently executing. It is reading and writing data as needed.

Partially Committed: The transaction has finished its operations but is not yet committed to the database.

Committed: The transaction has been successfully completed, and all changes have been saved.

Failed: This state occurs if the transaction cannot proceed due to an error. It can move to the aborted state.

Aborted: The transaction has been rolled back, undoing any changes made during the transaction.

Transaction Operations

These operations are the building blocks of transaction processing:

Begin Transaction: Marks the start of a transaction.

Read and Write Operations: Access and modify data in the database. These operations are interwoven with the main memory operations.

End Transaction: Indicates that the transaction has finished its operations.

Commit: Signals that the transaction is complete and changes can be saved.

Rollback: Reverts the database to its state before the transaction began if there is an error.

Understanding these components is essential for anyone working with advanced transaction processing. They ensure that systems are reliable, efficient, and capable of handling complex operations without losing data or performance.

Advanced Transaction Processing in Distributed Systems

In advanced transaction processing, distributed systems are like the backbone that holds everything together, especially when it comes to handling massive amounts of data across various locations. Let's explore how distributed DBMS, concurrency control, and replication control play a crucial role in this process.

Distributed DBMS

A distributed DBMS (Database Management System) is a system that manages a database spread across multiple locations. This setup offers several advantages, such as improved reliability, availability, and performance. It allows businesses to store and process data closer to where it's needed, reducing latency and enhancing user experience.

Imagine a company with offices in Chicago, Fresno, and Providence. A distributed DBMS ensures that each location has access to the data it needs, while still maintaining a unified database system. This setup is essential for businesses that require real-time data access and processing across different regions.

Concurrency Control

Concurrency control is all about managing simultaneous operations without causing conflicts or data inconsistencies. In distributed systems, multiple transactions may occur at the same time, potentially accessing the same data. Without proper control, this can lead to issues like data being read or written incorrectly.

To handle this, systems use techniques like locking and timestamps to ensure transactions are isolated from one another. This means that even if two transactions happen at the same time, they won't interfere with each other. It's like having a traffic light system that ensures cars (or transactions) flow smoothly without collisions.

Replication Control

Replication control involves copying data from one database to another to ensure consistency and availability. This is particularly important in distributed systems, where data needs to be accessible across multiple locations.

Replication ensures that if one database node fails, others can continue to operate without interruption. It also helps in balancing the load by allowing read operations to be distributed across different nodes, improving performance. Think of it as having backup singers in a band—if the lead singer (or a primary database node) loses their voice, the show can go on seamlessly.

In summary, distributed DBMS, concurrency control, and replication control are vital components of advanced transaction processing in distributed systems. They ensure that data is accessible, consistent, and reliable across multiple locations, enabling businesses to operate efficiently and effectively.

Optimizing Advanced Transaction Processing

When it comes to advanced transaction processing, optimization is key. Let's explore how performance benchmarks, transaction manager settings, and memory resident data play a role in achieving peak efficiency.

Performance Benchmarks

Performance benchmarks are like the report card for your transaction processing system. They help measure how well your system handles tasks like processing transactions, managing data, and maintaining speed. The TPC benchmarks, such as TPC-A and TPC-B, were designed to test systems under heavy loads. They focus on tasks like debiting and crediting accounts, which are common in banking applications.

Even though TPC-A/B are retired, they taught us valuable lessons about potential bottlenecks. For instance, if your system struggles with random access to account records or can't handle simultaneous transactions smoothly, it's time to revisit your setup. Think of these benchmarks as a way to ensure your system is running like a well-oiled machine.

Transaction Manager Settings

The transaction manager is the brain behind transaction processing. It oversees tasks like scheduling transactions, maintaining data integrity, and ensuring that everything runs smoothly. Fine-tuning its settings can significantly impact performance.

For example, adjusting the number of Worker Threads can help control how many transactions your system processes at once. More threads mean more transactions can be handled simultaneously, but it also requires more resources. Similarly, settings like Lease Duration and Lease Renewal affect how transactions are locked and retried, which can impact system load and performance.

A practical tip: If you decide to tweak these settings, changes often require a system restart to take effect. So, plan accordingly to minimize downtime.

Memory Resident Data

Memory resident data is like having a super-fast lane for your transactions. Instead of going back and forth to the disk for data, keeping frequently accessed data in memory speeds up processing times. It's like having your favorite snacks within arm's reach rather than having to walk to the kitchen every time you're hungry.

Using memory resident data can drastically reduce latency and improve the overall responsiveness of your system. However, it's important to balance memory usage with available resources to avoid overloading your system.

Incorporating these strategies into your advanced transaction processing setup can lead to significant improvements in speed, efficiency, and reliability. By understanding and optimizing these components, businesses can ensure their transaction systems are ready to handle whatever comes their way.

Frequently Asked Questions about Advanced Transaction Processing

What is transaction processing in advanced DBMS?

In an advanced Database Management System (DBMS), transaction processing refers to handling multiple operations as a single, cohesive action. This ensures that all tasks succeed together or not at all. Think of it like baking a cake: if one ingredient is missing, the whole cake might not turn out right. Similarly, in a transaction, if one part fails, everything is rolled back to maintain data integrity.

What are the 5 steps of transaction processing?

Transaction processing involves five key steps:

Input Data: Gathering the necessary information for the transaction. For example, entering a customer's order details in an online shopping system.

Store Data: Saving the input data in the database for processing. This is like putting all your ingredients on the counter before starting to cook.

Process Data: Performing the necessary computations or operations. In a bank, this could mean calculating interest on an account.

Output Information: Providing the results of the processed data. This could be a confirmation message that a payment was successful.

Data Retrieval: Accessing stored data for future use or reference. For instance, pulling up past transactions for a customer service inquiry.

What are examples of transaction processing systems?

Transaction processing systems are everywhere in our daily lives. Here are a few examples:

Online Banking: Allows users to transfer money, pay bills, and check balances in real-time. Each action is a transaction that must be processed accurately and quickly.

Stock Exchanges: Transactions here involve buying and selling shares. The system must handle these operations swiftly to reflect real-time market conditions.

Airline Reservations: When booking a flight, the system processes seat availability, pricing, and customer details as a single transaction to ensure you get the right seat at the right price.

These systems are designed to handle high volumes efficiently, ensuring that each transaction is completed accurately and reliably.

Conclusion

At Merchant Payment Services, we pride ourselves on delivering exceptional service and reliable financial solutions custom to your business needs. Our approach is simple: we offer a risk-free, month-to-month agreement with no startup or hidden fees. This ensures that you can focus on what truly matters—growing your business—without worrying about unexpected costs.

Our payment processing solutions are designed to be flexible and user-friendly. We provide free terminals, POS systems, and mobile payment options to help you accept payments anywhere, whether in-store, online, or on the go. This flexibility allows you to streamline your operations and improve customer satisfaction.

With locations in Chicago, IL, Fresno, CA, and Providence, RI, we are committed to serving businesses across the United States. Our dedication to integrity and exceptional service is recognized by the Better Business Bureau, setting us apart in an industry often focused solely on price.

For businesses looking to simplify their payment processing while ensuring compliance with industry standards, we offer simplified PCI compliance solutions. Explore our services to see how we can help your business thrive.

Merchant Payment Services is here to support you with advanced transaction processing, ensuring your operations run smoothly and efficiently. Let us be your trusted partner in achieving financial success.