Advanced Payment Processing: The Ultimate How-To Guide

Advanced payment processing is a powerful tool for managing cash flow, mitigating risk, and building trust between business partners. Let's break it down quickly:

Advance Payments: Payments made ahead of schedule to secure goods or services.

Cash Flow: Helps maintain financial stability by predicting future expenses and income.

Risk Mitigation: Protects against potential losses by ensuring payments are made upfront.

These elements are critical for small retail business owners looking to streamline their payment solutions and reduce transaction fees while meeting the growing demands of their customers.

I'm Lydia Valberg, co-owner of Merchant Payment Services. Over the years, I've helped numerous businesses steer the complexities of advanced payment processing, drawing on my family's 35-year legacy in facilitating secure and efficient transactions. Let's dive deeper into how these processes can benefit your business.

Understanding Advanced Payment Processing

Advanced payment processing is a game-changer for businesses. It involves handling payments in a way that boosts cash flow, reduces risks, and builds trust. Let's explore how this works.

Advance Payments

Advance payments are made before the delivery of goods or services. They act as a financial cushion, ensuring businesses can cover costs and maintain operations smoothly. These payments can secure products or services, serve as deposits, or show commitment to a transaction.

Example: In the hospitality industry, a hotel might require an advance payment to confirm a reservation, ensuring the room is held for the guest.

Payment Methods

There are several methods for processing advance payments. Each has its benefits and can be custom to fit a business's needs:

Bank Transfers: Reliable and direct, bank transfers are a common choice for advance payments. They provide a clear record and are generally secure.

Credit/Debit Cards: Widely used for their convenience and speed. They allow businesses to receive payments quickly, improving cash flow.

Letters of Credit: Often used in international transactions, they provide a guarantee that payment will be made once conditions are met.

Cash Discount

A cash discount is an incentive offered to buyers for paying their invoices early. This strategy can improve cash flow and reduce the time it takes to collect payments.

Benefit: By offering a small discount, businesses can encourage quicker payments, which means they have access to funds sooner.

Why It Matters

Understanding and implementing advanced payment processing can significantly impact a business's financial health. It helps in:

Managing Cash Flow: Ensures that funds are available when needed, avoiding cash shortages.

Building Trust: Demonstrates reliability and commitment, strengthening relationships with partners and customers.

Mitigating Risks: Protects against potential losses by securing payments before delivering goods or services.

For small business owners, mastering these payment processes means more than just keeping the lights on. It’s about thriving in a competitive market by leveraging every available tool to improve financial stability and customer satisfaction.

Next, we’ll explore the key benefits of advanced payment processing and how they can transform your business operations.

Key Benefits of Advanced Payment Processing

Advanced payment processing offers several crucial benefits that can transform how businesses operate. Let's break down the key advantages:

Cash Flow Management

Managing cash flow is vital for any business, and advanced payment processing plays a significant role here. By receiving payments in advance, businesses can better predict their financial situation. This foresight allows for more accurate budgeting and planning.

Predictable Cash Flow: With advance payments, businesses know when funds will be available, reducing the risk of cash shortages.

Example: A manufacturing company might require advance payments to purchase raw materials, ensuring production isn't delayed.

Trust-Building

Building and maintaining trust with partners and customers is essential. Advance payments can help establish this trust by demonstrating a commitment to the transaction.

Reliability: When a business receives an advance payment, it signals to customers and suppliers that the company is dependable.

Example: An event planner requiring a deposit for services shows commitment, reassuring clients that their event will be prioritized.

Risk Mitigation

Risk is an inherent part of doing business. Advanced payment processing helps mitigate these risks by securing funds before delivering goods or services.

Protection Against Nonpayment: By receiving payment upfront, businesses reduce the risk of customers not paying after receiving the product or service.

Example: A custom furniture maker might require a deposit to cover material costs, ensuring they are not out-of-pocket if the buyer cancels.

These benefits of advanced payment processing not only improve financial stability but also strengthen business relationships. By managing cash flow effectively, building trust, and mitigating risks, businesses can focus on growth and innovation.

In the next section, we'll dive into advanced payment processing techniques that can further optimize your financial operations.

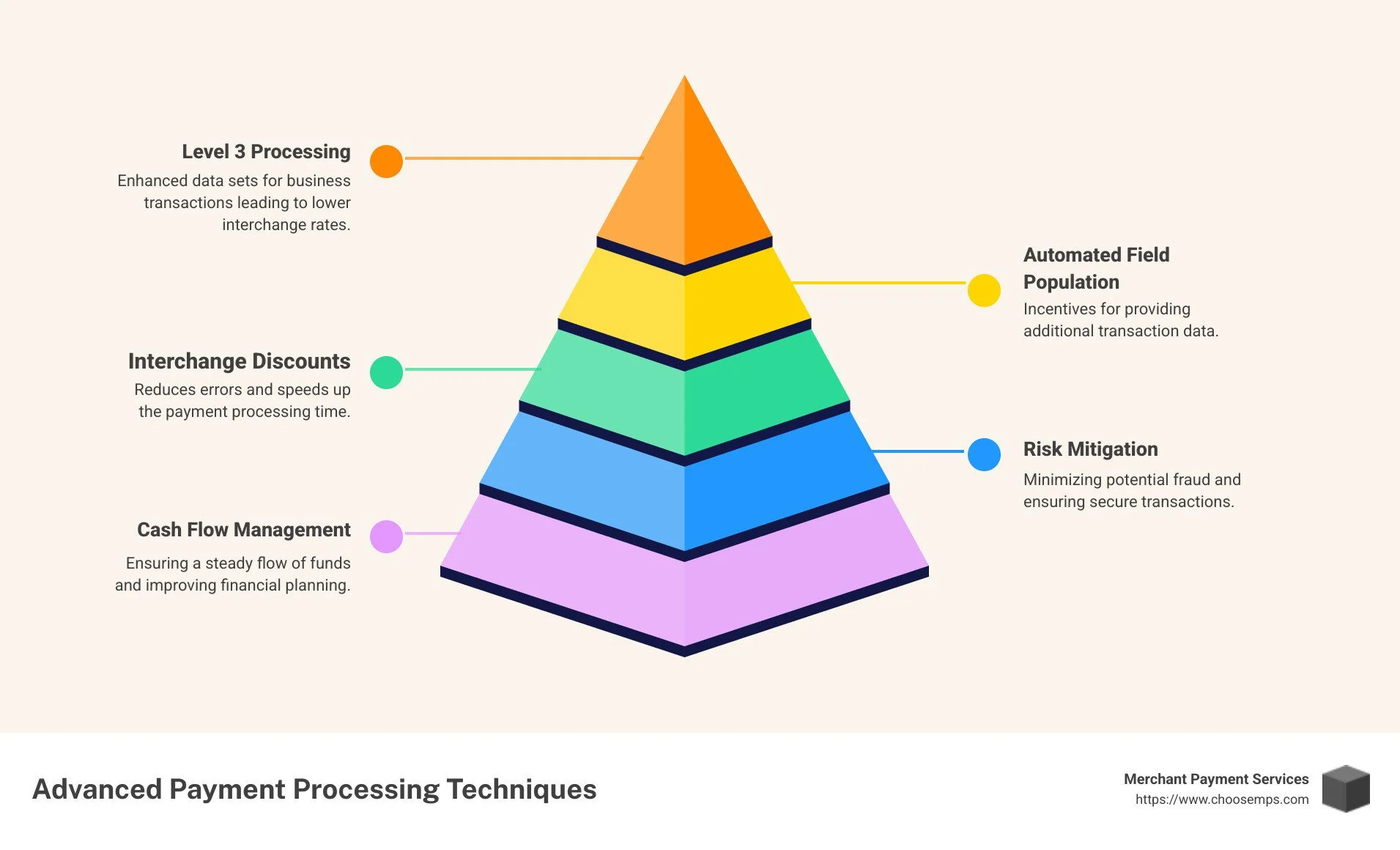

Advanced Payment Processing Techniques

When it comes to advanced payment processing, there are several techniques that can help streamline operations and reduce costs. Let's explore some of these methods:

Level 3 Processing

Level 3 processing is like the secret weapon for businesses dealing with B2B and B2G transactions. It includes up to 11 detailed data fields in each transaction, which can significantly reduce the cost of accepting credit cards by up to 1.2%.

Why Use Level 3?: It provides more detailed information, such as item descriptions and quantities, which can lead to lower interchange rates.

Who Benefits?: Businesses with large transaction volumes, like wholesalers and manufacturers, can see substantial savings.

Automated Field Population

One of the challenges with Level 3 processing is the manual entry of detailed data. This is where automated field population comes in handy.

Error-Free Transactions: Automation ensures that all necessary fields are filled accurately, reducing the chances of errors.

Efficiency: Saves time and effort, allowing staff to focus on more critical tasks.

Interchange Discounts

By leveraging Level 3 processing and automated field population, businesses can maximize their interchange discounts. These discounts are reductions in the fees paid to card networks and can lead to significant cost savings.

How It Works: Properly categorized transactions receive lower rates, which translates into savings.

Real-Life Impact: Imagine saving a percentage on every transaction—over time, this adds up to thousands of dollars saved.

By incorporating these advanced payment processing techniques, businesses can optimize their payment systems, reduce costs, and improve overall efficiency. In the next section, we'll explore various methods for processing advanced payments.

Advanced Payment Processing Methods

When it comes to advanced payment processing, selecting the right method is crucial. Let's explore some of the most effective methods used today:

Bank Transfers

Bank transfers are a reliable and straightforward method for processing payments. They involve moving money directly from one bank account to another.

Why Choose Bank Transfers?: They are secure and often incur lower fees than other payment methods. They're ideal for large transactions, providing a clear audit trail.

How It Works: The payer instructs their bank to transfer a specific amount to the recipient’s account. This can be done via online banking, mobile apps, or in-person at a bank branch.

Credit/Debit Cards

Credit and debit cards are ubiquitous and offer convenience for both businesses and customers.

Benefits: Fast processing times and widespread acceptance make them a favorite. They also provide an opportunity for businesses to offer cash discounts for early payments.

Considerations: While convenient, be aware of processing fees, which can range from 1.4% to 3.5% per transaction. However, using techniques like Level 3 processing can help reduce these costs.

Credit Letters

Credit letters, often referred to as Letters of Credit (LC), are used primarily in international trade to ensure that payments will be received.

What Are They?: A credit letter is a guarantee from a bank that the seller will receive payment as long as the delivery conditions are met.

Usage: They are commonly used in scenarios where the buyer and seller are unfamiliar with each other, providing a layer of trust and security.

Process: Once the seller ships the goods and presents the necessary documents, the bank releases the funds.

Each of these methods offers unique advantages and can be custom to fit the needs of your business. By understanding and implementing the right advanced payment processing methods, you can improve your financial operations and improve cash flow management.

In the next section, we'll address common questions about the advanced payment process to further clarify how these methods can benefit your business.

Frequently Asked Questions about Advanced Payment Processing

What is the process of advance payment?

Advance payment is when you pay for goods or services before you actually receive them. This process usually involves a prepayment to secure the product or service.

Here's a simple breakdown:

Prepayment: You pay a portion or the full amount upfront.

Goods/Services: The seller prepares and delivers the goods or services.

Balance: If there's any remaining balance, it's paid after you receive the goods or services.

Advance payments are often used to ensure commitment and build trust between business partners.

How long does it take to get advanced payment?

The time it takes to process an advance payment can vary. However, in many cases, it can be quite swift:

DWP (Department for Work and Pensions): For certain government-related payments, it can take about 3 working days.

Same Day: Some transactions, especially smaller ones, can be processed the same day, depending on the payment method and banking systems involved.

Understanding the timeline helps in planning and managing cash flow effectively.

Why does my credit card payment say processing?

When your credit card payment says "processing," it means the transaction is going through a series of steps to ensure everything is in order:

Processed: The payment request has been received and is being handled by the payment processor.

Approved: Once the banking system verifies the details, the payment is approved.

Banking System: The bank checks for funds, fraud, and other security measures before finalizing the transaction.

This process ensures that both parties in the transaction are protected and that funds are accurately transferred.

In the next section, we'll explore how Merchant Payment Services can provide custom solutions to streamline your payment processes.

Conclusion

Advanced payment processing can transform how businesses handle transactions, and Merchant Payment Services is here to make that transition seamless. Our solutions are designed to simplify payment acceptance, whether you're at the counter, online, or on the go.

With free terminals and POS systems, we offer a risk-free, month-to-month agreement with no startup or hidden fees. This ensures you get exceptional service without the stress of long-term commitments or unexpected costs. Our solutions are custom to meet the needs of businesses of all sizes, ensuring you can manage cash flow effectively and build trust with your partners.

Our focus on exceptional service and integrity sets us apart. We prioritize building relationships with our clients, ensuring that you receive not just a service, but a partnership. Our team is committed to helping you choose the right payment solutions that align with your business goals.

For more information about our comprehensive range of payment solutions, check out our POS systems and see how we can help streamline your operations.

Merchant Payment Services is dedicated to providing exceptional payment solutions with integrity and reliability, helping your business grow and succeed.